What is a Reverse Mortgage?

Definition and Basics

A reverse mortgage is a financial product designed for homeowners aged 55 or older, allowing them to access a portion of their home’s equity as tax-free funds. According to the Government of Canada, homeowners can typically borrow up to 55% of their home’s current value. The homeowner retains ownership and can use the funds for various needs, such as supplementing retirement income or covering unexpected expenses. Repayment is deferred until the homeowner sells the property, moves out, or passes away.

Key Statistic: The Office of the Superintendent of Financial Institutions (OSFI) reports that Canadians now hold more than $8.5 billion in reverse mortgage debt outstanding as of August 2024, representing an 18% increase from the previous year. [Financial Post]

How It Differs from a Traditional Mortgage

Traditional mortgages require regular payments of principal and interest, and the loan balance decreases over time. In contrast, reverse mortgages do not require monthly payments. Instead, the loan balance increases as interest accumulates, and repayment occurs when the property is sold or the homeowner no longer occupies the home. This structure is particularly beneficial for retirees seeking financial flexibility without the burden of monthly payments.

How Reverse Mortgages Work

Eligibility Criteria in Canada (Vancouver/BC/Alberta)

Age and Home Ownership Requirements

To qualify for a reverse mortgage in Canada, applicants must be at least 55 years old according to federal regulations. If the property is co-owned, both owners must meet the minimum age requirement. Additionally, the home must be the primary residence, meaning the homeowner lives in it for at least six months of the year.

Types of Eligible Properties

Eligible properties include single-family homes, townhouses, and condominiums. In some cases, rural properties may also qualify, provided they meet the lender’s criteria. Properties must also be well-maintained and located in areas with strong real estate markets, such as Vancouver, BC, or Alberta’s urban centers.

Loan Amount Calculation

Role of Home Equity in Determining Value

The loan amount is determined based on the homeowner’s age, the value of the property, and the amount of equity available. Generally, older homeowners with higher equity in their homes can borrow a larger percentage of their home’s value. Appraisals are conducted to confirm the market value of the property, ensuring the loan amount aligns with the lender’s policies.

Key Terms to Know (e.g., interest rates, repayment structure)

Reverse mortgages have specific terms that borrowers should understand, including:

- Interest Rates: Current rates in Canada range from 7% to 10% as of 2024, typically higher than traditional mortgages and may be fixed or variable, depending on the lender. [Source]

- Repayment Structure: Borrowers do not make monthly payments. Instead, the loan, along with accumulated interest, is repaid when the homeowner sells the property, moves out, or passes away.

- Prepayment Options: Some lenders offer flexible prepayment options, but these may come with penalties depending on the loan agreement.

💡 Interactive Calculator

Use the CHIP Reverse Mortgage Calculator to estimate how much you might be able to borrow based on your age and home value.

Benefits of Reverse Mortgages

Financial Flexibility for Retirees

Reverse mortgages offer retirees a flexible source of income by converting home equity into cash. According to HomeEquity Bank, reverse mortgage borrowing increased by over 39% in 2024 compared to 2022, reflecting growing demand for this financial tool. This can help cover daily expenses, medical bills, or unexpected financial needs without the requirement of monthly repayments.

Tax-Free Income Source

The funds received from a reverse mortgage are not considered taxable income, allowing homeowners to maximize their available cash flow without affecting their tax bracket or government benefits like Old Age Security (OAS) or Guaranteed Income Supplement (GIS).

Staying in Your Home While Accessing Funds

One of the primary advantages of reverse mortgages is that they enable homeowners to remain in their homes while benefiting from its equity. This is particularly appealing to those who wish to age in place and maintain their familiar surroundings.

Risks and Considerations

Accruing Interest Over Time

One significant risk of reverse mortgages is that interest accrues over time, increasing the loan balance. According to NICE Information Tool, a $100,000 reverse mortgage balance can grow to $150,000 in 5 years based on August 2024 rates. Since no monthly payments are required, the total amount owed grows, which may consume a larger portion of the home’s equity over the years.

Impact on Inheritance for Heirs

A reverse mortgage can reduce the amount of equity left in the home, potentially limiting the inheritance for heirs. Families should consider the financial implications and discuss alternatives if leaving a substantial inheritance is a priority.

Fees and Associated Costs

Reverse mortgages come with various fees, such as origination fees, closing costs, and servicing fees. Additionally, higher interest rates compared to traditional mortgages can increase the overall cost of the loan. It’s crucial for homeowners to evaluate these costs when determining if a reverse mortgage is the right option.

⚠️ Important Consideration

Before proceeding with a reverse mortgage, consult with a financial advisor and consider getting independent legal advice as recommended by the Government of Canada.

Who Should Consider a Reverse Mortgage?

Ideal Candidates

Retirees with High Home Equity

Homeowners who have built significant equity in their homes and want to leverage it for financial support during retirement may benefit from a reverse mortgage. This option is particularly attractive for those who prefer to stay in their homes rather than downsizing.

Those Needing Supplemental Income

Seniors who require additional funds to cover living expenses, healthcare costs, or unexpected financial emergencies can use a reverse mortgage to ease financial pressures without needing to liquidate other assets. Recent data shows that 16% of reverse mortgage borrowers are using funds for “gifting purposes,” often to help adult children with down payments.

When to Avoid a Reverse Mortgage

Situations Where Alternatives Are Better

Reverse mortgages may not be suitable for those planning to move in the near future, as the associated fees and closing costs can outweigh the benefits for short-term use. Additionally, homeowners who want to leave their property as an inheritance or who qualify for other financial programs, such as HELOCs or government grants, might find these options more advantageous.

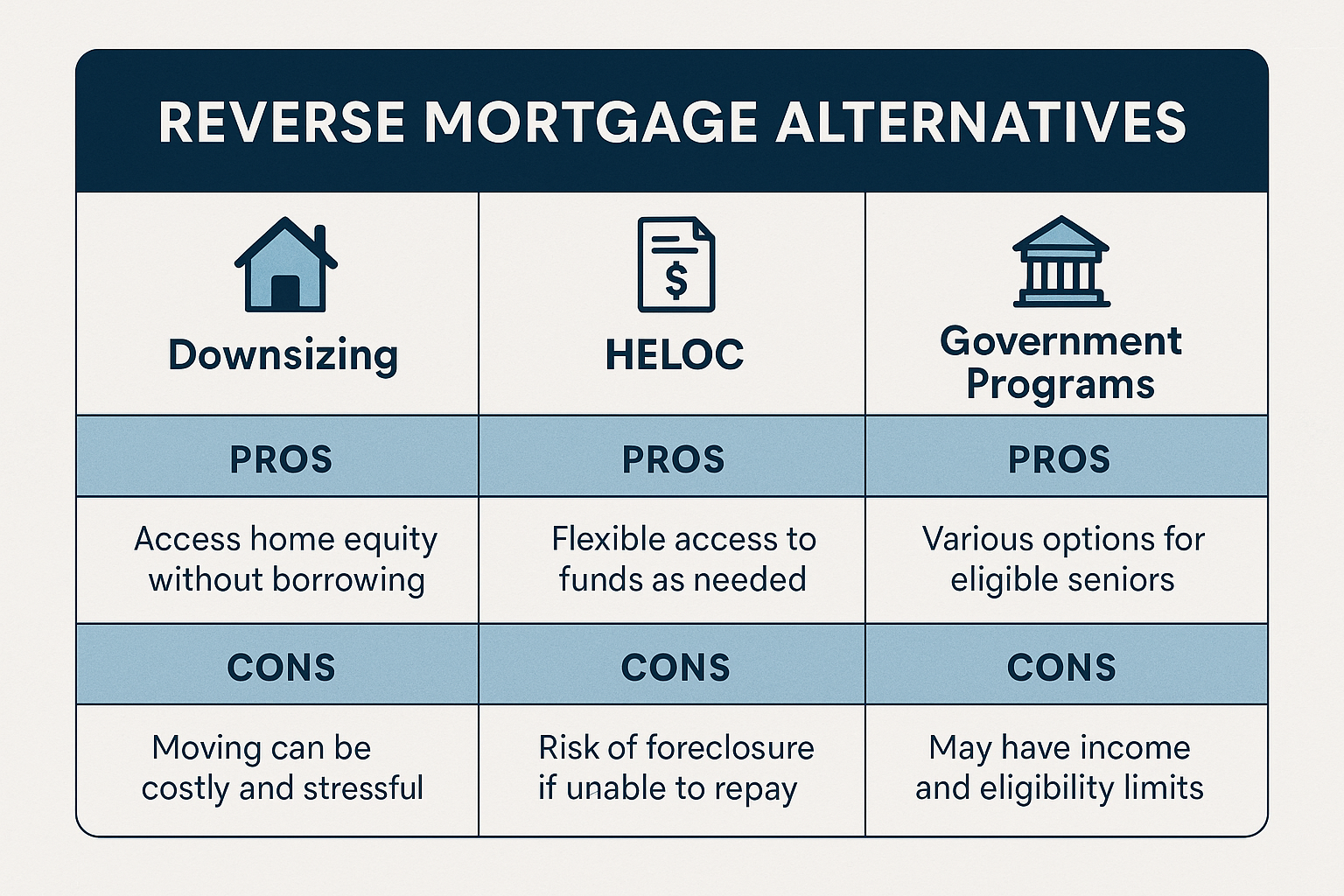

Alternatives to Reverse Mortgages

Downsizing Your Home

Downsizing involves selling your current home and purchasing a smaller, more affordable property. This option can free up significant funds while reducing maintenance and living expenses, making it an attractive alternative to a reverse mortgage for some homeowners.

Home Equity Line of Credit (HELOC)

A HELOC allows homeowners to access their home equity through a revolving line of credit. Unlike a reverse mortgage, HELOCs typically require monthly interest payments, but they often have lower interest rates (currently averaging about 8%) and fewer fees. This option works well for those who can manage regular payments and need flexibility in accessing funds.

Government Programs for Seniors

Various government programs in Canada provide financial support to seniors:

- Canada Pension Plan (CPP) – Maximum monthly payment in 2024

- Old Age Security (OAS) – Monthly payments for eligible seniors

- Guaranteed Income Supplement (GIS) – Additional support for low-income seniors

Additionally, local programs in provinces like BC and Alberta may offer property tax deferrals or other assistance to help reduce financial strain without requiring a reverse mortgage.

Reverse Mortgages in Canada: Regional Insights

Rules and Regulations in Vancouver/BC/Alberta

Reverse mortgages in Canada are governed by federal laws and specific provincial regulations. In British Columbia and Alberta, the minimum age to qualify is 55, and the home must be the primary residence. Additionally, the lender’s guidelines must comply with Canada’s mortgage and real estate standards, ensuring transparency and borrower protection under OSFI regulations.

Comparison of Providers in the Region

CHIP Reverse Mortgage by HomeEquity Bank

The CHIP Reverse Mortgage is one of the most popular options in Canada, offered by HomeEquity Bank. It provides flexible payout options and is specifically tailored to seniors looking to access up to 55% of their home’s equity. The application process is straightforward, and the bank has a strong presence in Vancouver, BC, and Alberta. HomeEquity Bank’s business grew almost 20% from 2023 to 2024, according to The Globe and Mail.

Other Regional Options

Other providers, such as Equitable Bank, also offer reverse mortgage products. Equitable Bank saw a 47% increase in its reverse mortgage business in 2024. These options may feature competitive interest rates or slightly different eligibility criteria. Working with a regional mortgage broker can help homeowners compare these alternatives and choose the best fit for their needs.

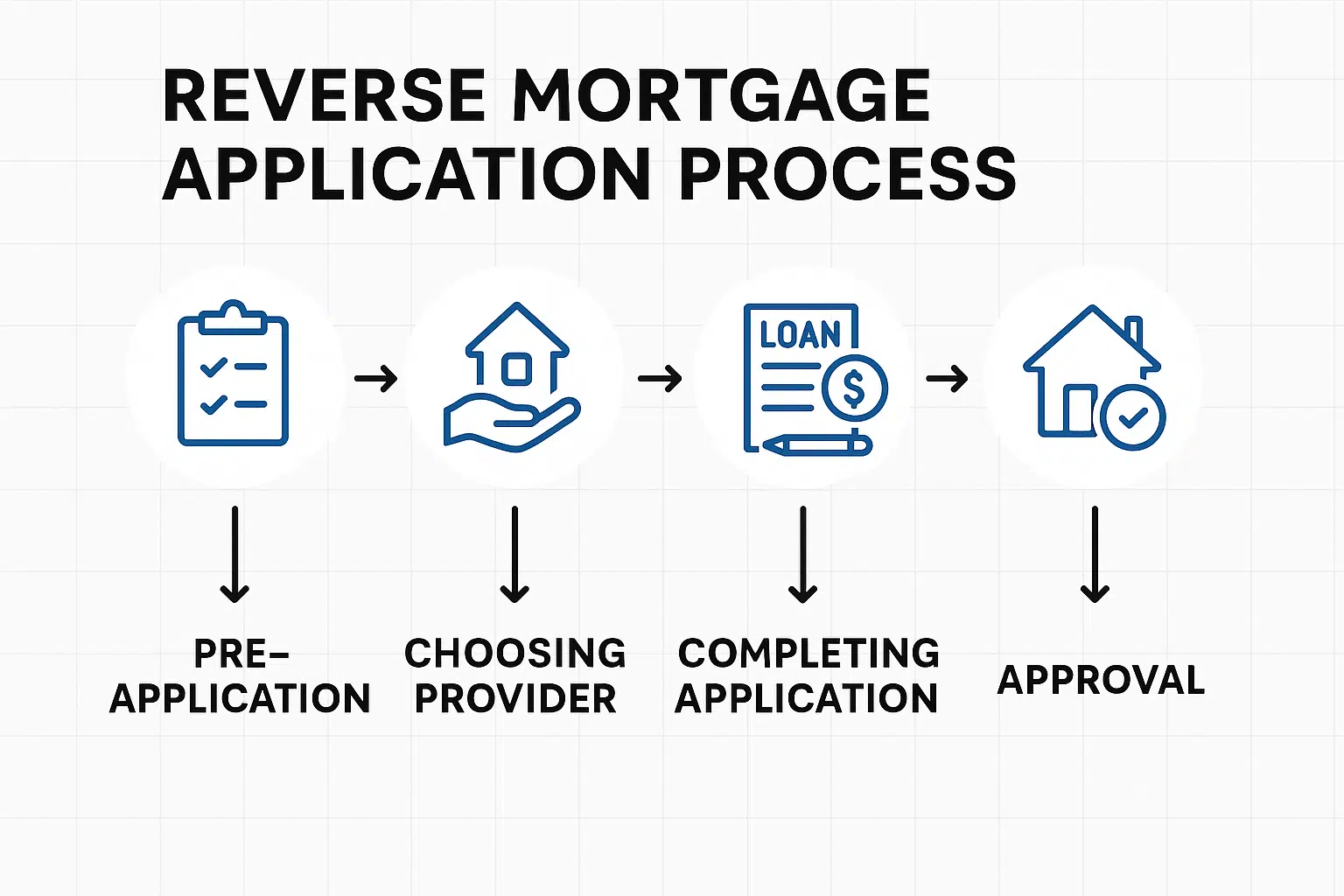

Steps to Apply for a Reverse Mortgage

Pre-Application Checklist

Before applying, homeowners should assess their financial situation and gather necessary documents. This includes proof of homeownership, age verification, and an estimate of the property’s market value. It’s also important to consider long-term financial goals and whether a reverse mortgage aligns with them.

Choosing the Right Provider

Research is key to selecting the best reverse mortgage provider. Compare interest rates, fees, and customer reviews from lenders operating in Vancouver, BC, and Alberta. Consulting with a mortgage broker or financial advisor can help identify the most suitable option.

Completing the Application Process

Once a provider is chosen, the application process involves submitting required documentation, undergoing a home appraisal, and reviewing the loan agreement. Borrowers should carefully read all terms and conditions and seek independent legal advice to ensure clarity before signing the final agreement.

📋 Quick Application Checklist

- ✅ Proof of age (55+ years old)

- ✅ Property ownership documents

- ✅ Home appraisal

- ✅ Financial assessment

- ✅ Independent legal advice

Common Myths About Reverse Mortgages

Myth 1: You Lose Ownership of Your Home

A common misconception is that taking out a reverse mortgage means giving up ownership of your home. In reality, the homeowner retains full ownership and control of the property. The lender simply places a lien on the home as security for the loan, similar to a traditional mortgage.

Myth 2: Reverse Mortgages Are a Last Resort

While reverse mortgages can be a lifeline for some, they are not exclusively for those in financial distress. Many retirees use reverse mortgages as a strategic financial tool to supplement income, fund home renovations, or invest in other opportunities without liquidating other assets.

Myth 3: You Can Be Forced to Sell Your Home

Reverse mortgages are designed to allow homeowners to stay in their homes as long as they meet the loan terms, such as maintaining the property and paying property taxes and insurance. Borrowers are not forced to sell unless they choose to move or fail to meet these obligations.

Conclusion

Summary of Key Points

Reverse mortgages provide an innovative solution for seniors to unlock home equity without selling their homes. By understanding the eligibility criteria, benefits, and risks, homeowners can make informed decisions tailored to their financial needs. With over $8.5 billion in reverse mortgage debt outstanding in Canada as of 2024, this financial tool continues to grow in popularity among Canadian seniors.

Final Considerations for Potential Applicants

Before deciding on a reverse mortgage, it’s essential to evaluate personal financial goals, consider alternative options, and understand the long-term impact on inheritance and equity. Comparing providers and reviewing terms carefully ensures the best fit for individual circumstances.

Encouragement to Seek Professional Advice

Seeking advice from financial advisors or mortgage brokers specializing in reverse mortgages can help clarify complex terms and align the decision with your broader financial plan. Expert guidance ensures that all aspects are considered before committing to this financial product.

🔗 Helpful Resources

FAQs About Reverse Mortgages

How Does Interest Accumulate on a Reverse Mortgage?

Interest on a reverse mortgage accumulates over time since no monthly payments are required. The total loan balance increases as interest compounds, and it is repaid along with the principal when the property is sold or the homeowner no longer resides in the home.

Can I Pay Off My Reverse Mortgage Early?

Yes, most reverse mortgage lenders allow early repayment. However, some may charge prepayment penalties depending on the terms of the loan. It is important to review the agreement carefully and consult with your lender.

What Happens if I Move Out?

If the homeowner moves out permanently, the reverse mortgage becomes due. The loan balance must be repaid, typically through the sale of the property. Temporary absences, such as stays in a hospital or care facility, may be allowed under certain conditions.

How Do Reverse Mortgages Affect My Estate?

A reverse mortgage reduces the home equity available to your estate. Heirs may need to repay the loan if they wish to keep the property, often by refinancing or using other assets. Any remaining equity after loan repayment belongs to the heirs.

What Are the Tax Implications?

Reverse mortgage funds are considered loan advances, not income, and are therefore not taxable. However, borrowers should ensure they continue to pay property taxes and insurance to comply with the loan terms.