A reverse mortgage is a financial product that enables homeowners aged 55 and older to tap into the equity of their homes without needing to sell or relocate. The loan is repaid only when the homeowner sells the property or moves out permanently, providing financial flexibility for retirees. This is especially relevant for residents in Vancouver, BC, and Alberta, where high housing market values and unique property dynamics significantly influence retirement planning strategies.

How Reverse Mortgages Work

What Is a Reverse Mortgage?

A reverse mortgage is a specialized loan designed for homeowners aged 55 and older, enabling them to access the equity in their home without the need to sell or move out. Unlike traditional mortgages, this financial product does not require homeowners to make regular payments. Instead, the loan is repaid when the property is sold or the homeowner moves out permanently, providing significant financial flexibility for retirees.

Video: Understanding the Basics of a CHIP Reverse Mortgage – HomeEquity BankHow Does It Work in Canada?

In Canada, reverse mortgages are tightly regulated financial tools that offer tax-free funds based on a percentage of the home’s value. Homeowners retain ownership and the right to live in their home while borrowing against its equity. Repayment is deferred until the homeowner sells the property, moves out, or passes away, ensuring there are no monthly payment obligations. Specific rules and conditions may vary across regions such as BC and Alberta, reflecting differences in property values and legal frameworks.

📌 Learn More: Government of Canada’s Official Reverse Mortgage Guide

Who Offers Reverse Mortgages in Canada?

In Canada, the reverse mortgage market is primarily served by two major lenders.

HomeEquity Bank (CHIP Reverse Mortgage) provides flexible payout options, allowing homeowners to receive funds as lump sums, monthly payments, or a combination of both. This lender eliminates the need for ongoing repayments while the homeowner continues to reside in the property. With extensive experience and a well-established presence in the Canadian market, HomeEquity Bank is a trusted choice for many seniors.

Equitable Bank is another key player in the reverse mortgage market. It offers competitive interest rates tailored to the specific needs of homeowners. The bank emphasizes transparency in its terms and conditions, building trust with clients. Additionally, Equitable Bank provides innovative solutions and a personalized approach to ensure borrowers find the best fit for their financial goals.

Both institutions operate under Canadian regulations, ensuring consumer protection and reliability for seniors considering reverse mortgage options.

📊 Calculate Your Options: CHIP Reverse Mortgage Calculator

Eligibility Criteria for Reverse Mortgages in BC/Alberta

Age Requirements

To qualify for a reverse mortgage in Canada, including BC and Alberta, homeowners must typically be at least 55 years old. This minimum age requirement applies to all individuals listed on the property title. In some cases, exceptions or variations may exist depending on lender policies or specific regional considerations.

Property Requirements

Eligible properties for reverse mortgages generally include primary residences such as single-family homes, townhouses, and condos. The property must meet minimum valuation thresholds determined by the lender to ensure it holds sufficient equity. Additionally, the home must be well-maintained and situated in a marketable area, as evaluated by the lender.

🏠 Property Value Requirements:

- Minimum Home Value: $250,000 (HomeEquity Bank) / $200,000 (Equitable Bank)

- Maximum Borrowing: Up to 55% of appraised home value

- Property Types: Primary residences, condos, townhouses

Other Factors

While credit history is less critical for reverse mortgage approval compared to traditional loans, lenders may still review financial stability to ensure that homeowners can manage ongoing expenses such as property taxes, insurance, and maintenance. Furthermore, any outstanding mortgage balance on the property must be low enough to be fully covered by the reverse mortgage loan amount.

Source: HomeEquity Bank

Benefits of Reverse Mortgages

Supplementing Retirement Income

Reverse mortgages provide homeowners aged 55 and older with access to tax-free funds, offering a practical solution for alleviating financial stress during retirement. These funds can serve as a steady source of income, helping to cover daily living expenses or unexpected costs, thereby improving overall financial security for retirees.

Flexibility in Fund Usage

One of the most appealing aspects of reverse mortgages is the freedom to use the funds as needed. Homeowners can allocate these funds for a variety of purposes, such as covering medical expenses or long-term care, undertaking renovations or maintenance to enhance their home’s value, or supporting lifestyle choices like traveling or pursuing hobbies. This flexibility makes reverse mortgages a versatile financial tool for meeting individual needs and goals.

No Monthly Mortgage Payments

Unlike traditional loans, reverse mortgages eliminate the burden of monthly repayments, making them particularly beneficial for retirees living on a fixed income. The loan balance is only repaid when the homeowner sells the property, moves out permanently, or passes away, allowing them to remain in their home without the financial strain of regular payments.

| Common Uses | Percentage of Borrowers | Average Amount |

|---|---|---|

| Home Renovations | 35% | $45,000 |

| Medical Expenses | 28% | $32,000 |

| Daily Living Expenses | 25% | $28,000 |

| Travel & Leisure | 15% | $18,000 |

| Emergency Fund | 20% | $25,000 |

Data compiled from industry sources and lender reports

Risks of Reverse Mortgages

Decreasing Home Equity

Over time, as interest accumulates on the loan, the homeowner’s equity in the property decreases. This gradual reduction in equity can limit future options for selling the property or passing it on to heirs. As the loan balance grows, it’s important to understand that less of the home’s value may remain available for other financial needs or family inheritance.

Impact on Heirs and Estate

Reverse mortgages must be repaid when the homeowner sells the home, moves out permanently, or passes away. If the loan balance exceeds the value of the home, this could significantly reduce or eliminate the inheritance left for heirs. However, most reverse mortgages include a non-recourse clause, which ensures that the borrower’s estate will not owe more than the home’s market value, even if the loan balance surpasses it.

Potential Costs

Reverse mortgages can include a variety of fees and costs that borrowers should carefully consider. Hidden fees such as origination fees, closing costs, and legal expenses can increase the overall cost of the loan. Additionally, homeowners remain responsible for ongoing expenses like property taxes, home insurance, and maintenance. Failure to meet these responsibilities could jeopardize the loan agreement. Furthermore, early repayment fees may apply if the loan is paid off before its term, making it essential to understand all associated costs upfront.

Video: Getting a Reverse Mortgage in Canada | ASK THE MONEY LADY – Christine IbbotsonHow to Determine if a Reverse Mortgage Is Right for You

Assessing Your Financial Situation

Before considering a reverse mortgage, it is essential to evaluate your current financial standing. Begin by reviewing your income sources, savings, debts, and any future financial needs. Take into account ongoing expenses such as property taxes, home maintenance, and insurance to ensure that you can sustain these costs while benefiting from the reverse mortgage.

Comparing Alternatives

When exploring financial options, consider alternatives to reverse mortgages. One common choice is downsizing, where you sell your current home and move to a smaller, less expensive property. This can provide similar financial relief without the accumulation of interest. Another option is using traditional lines of credit or personal loans, which may offer lower costs if you are eligible and can manage regular repayments. For those who need access to equity but wish to retain their home’s equity, a Home Equity Line of Credit (HELOC) could be a viable alternative.

| Factor | Reverse Mortgage | Downsizing |

|---|---|---|

| Stay in Current Home | ✅ Yes | ❌ No |

| Upfront Costs | Setup fees (~$995) | Moving costs, realtor fees |

| Monthly Payments | ✅ None required | New mortgage payments |

| Tax Implications | ✅ Tax-free funds | Capital gains may apply |

| Flexibility | ✅ High | Limited by new home |

| Long-term Costs | Interest accumulation | Lower maintenance costs |

🎥 Watch: Reverse Mortgage vs Downsizing Comparison

Consulting Professionals

Consulting with financial planners or mortgage brokers is a crucial step in the decision-making process. These professionals can provide tailored advice, helping you understand the long-term implications of a reverse mortgage. They can also assist in comparing the costs, benefits, and risks of a reverse mortgage with other financial solutions, ensuring you make an informed decision suited to your specific circumstances and location, such as BC or Alberta.

📞 Professional Resources:

- Canadian Association of Mortgage Professionals

- Financial Planning Association of Canada

- CMHC Housing Solutions

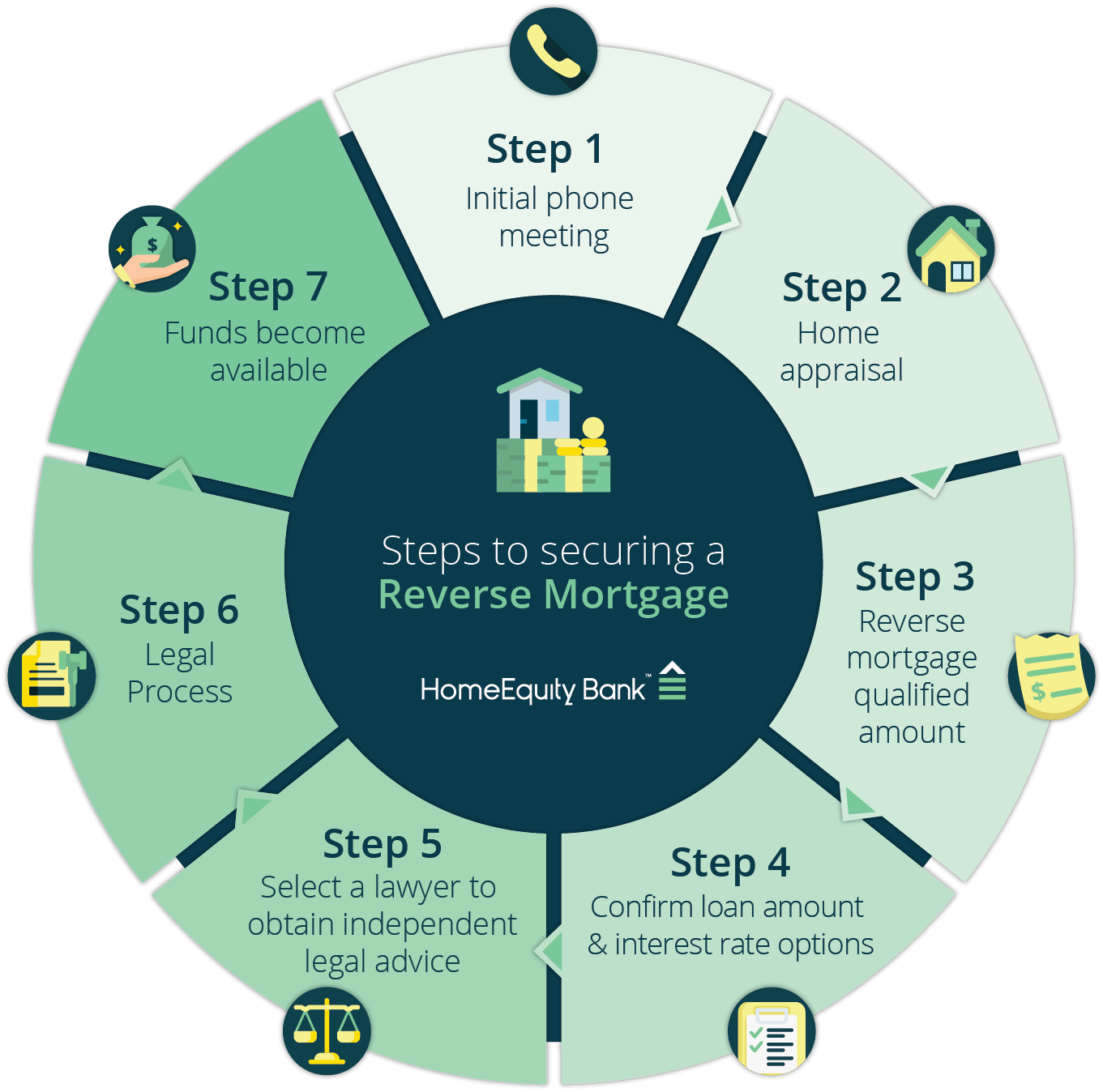

Steps to Get a Reverse Mortgage in BC/Alberta

Step 1: Research Lenders

Identifying a trustworthy lender is a crucial first step in the reverse mortgage process. Start by reviewing online ratings, customer testimonials, and accreditation from regulatory bodies. Focus on lenders that specialize in reverse mortgages, such as HomeEquity Bank or Equitable Bank, which operate widely across BC and Alberta. Take time to compare interest rates, fees, and loan terms to ensure you select the option that best suits your financial needs.

Step 2: Apply for a Reverse Mortgage

Once you’ve chosen a lender, the next step is to gather the necessary documentation. This typically includes proof of age, such as a government-issued ID, proof of homeownership, and recent property tax records. Additionally, prepare financial statements to demonstrate your ability to manage ongoing costs like property taxes and insurance. Submit a formal application through the lender’s designated process, ensuring that all fields are completed and required attachments are included.

Step 3: Finalize the Agreement

Before finalizing your reverse mortgage, thoroughly review the loan terms, including the interest rates, repayment conditions, and any penalties for early repayment. To ensure you fully understand the agreement, consult with a financial advisor or lawyer who can provide professional guidance. Once you’re confident in the terms, sign the agreement and complete any final steps required by the lender to activate your reverse mortgage.

📋 Required Documents Checklist:

- [ ] Government-issued photo ID

- [ ] Proof of homeownership (deed/title)

- [ ] Property tax assessments (last 2 years)

- [ ] Home insurance documents

- [ ] Financial statements

- [ ] Mortgage statements (if applicable)

- [ ] Proof of income (pension statements, etc.)

Current Interest Rates & Market Information

💰 Current Reverse Mortgage Rates (2025)

| Lender | 1-Year Fixed | 3-Year Fixed | 5-Year Fixed |

|---|---|---|---|

| HomeEquity Bank (CHIP) | 6.89% | 6.89% | 6.74% |

| Equitable Bank | 6.89% | 6.69% | 6.49% |

Rates as of January 2025. Visit Equitable Bank Rates for current rates.

🎥 Educational Video: Canadian Reverse Mortgages Explained

Final Thoughts

Reverse mortgages provide homeowners aged 55 and older with a practical way to access their home equity without the need to sell or relocate, offering financial flexibility and peace of mind during retirement. However, it is crucial to weigh the advantages, such as supplemental income and the absence of monthly payments, against potential risks, including reduced home equity and associated costs. Consulting with professionals like financial advisors and mortgage brokers ensures informed decision-making tailored to individual circumstances. By leveraging trusted resources and engaging with local experts in BC and Alberta, homeowners can determine how a reverse mortgage fits into their retirement strategy.

🔗 Additional Resources: – HomeEquity Bank Calculator – Government of Canada Reverse Mortgage Guide – Equitable Bank Information

FAQs

What happens if I sell my home with a reverse mortgage?

If you sell your home, the reverse mortgage must be repaid in full. The repayment amount will include the original loan amount, along with any accrued interest and associated fees. Once the loan balance is settled, any remaining proceeds from the home sale are yours to keep. This ensures that homeowners can benefit from the increased value of their property, even after repaying the reverse mortgage.

Can I lose my home?

You cannot lose your home as long as you comply with the terms of the reverse mortgage. This includes maintaining the property in good condition, paying property taxes on time, and keeping your home insurance current. However, failure to meet these obligations could result in the lender foreclosing on the property. It’s essential to understand and adhere to all the terms outlined in your reverse mortgage agreement to avoid any risks.

Are reverse mortgages taxable in Canada?

Reverse mortgage funds are not considered taxable income, meaning you won’t need to pay income tax on the money you receive. This tax-free nature makes reverse mortgages an attractive financial tool for retirees. Nevertheless, it’s advisable to consult a tax professional to fully understand how reverse mortgage funds might impact other aspects of your financial situation, including government benefits or estate planning.

Can I apply for a reverse mortgage jointly?

Yes, you can apply for a reverse mortgage jointly if all owners listed on the property title meet the eligibility criteria. This means both individuals must be at least 55 years old in Canada. The reverse mortgage remains in effect until the last borrower moves out of the home permanently, sells the property, or passes away. This ensures that the loan terms are tailored to the needs of both applicants.

What if my home value decreases?

Most reverse mortgages in Canada include a “no negative equity guarantee,” which ensures that borrowers will never owe more than the home’s market value at the time of sale. If the home’s value decreases and is insufficient to cover the loan balance, the lender absorbs the loss. This clause provides significant financial protection for borrowers and their heirs, giving peace of mind that neither they nor their estate will bear the burden of any shortfall.