As housing prices in Vancouver continue to rise, many seniors are looking for ways to leverage their home equity while maintaining financial independence. A reverse mortgage is an increasingly popular option for homeowners aged 55 and older, allowing them to access tax-free funds without selling their property. However, there are key considerations, including how the loan works, repayment terms, and the differences between Canadian and U.S. reverse mortgages.

This guide provides a clear and practical breakdown of reverse mortgages in Vancouver, BC, helping seniors make informed decisions about their financial future.

Understanding Reverse Mortgages in Vancouver

What Is a Reverse Mortgage?

A reverse mortgage is a type of loan available to Canadian homeowners aged 55+ that allows them to borrow against their home equity while continuing to live in their residence. Unlike a traditional mortgage, where borrowers make monthly payments to reduce their debt, a reverse mortgage does not require regular payments. Instead, the loan accumulates interest over time and is repaid when the homeowner sells the property, moves into long-term care, or passes away.

Key characteristics of a reverse mortgage:

- No monthly mortgage payments required

- Loan is repaid when the home is sold or owner passes away

- Funds are tax-free and can be used for any purpose

- Homeownership remains in the borrower’s name

For many seniors, a reverse mortgage offers financial flexibility by providing lump-sum or monthly payments to cover living expenses, medical costs, or home renovations.

How Does a Reverse Mortgage Work in Canada?

A reverse mortgage in Canada follows a specific loan structure that differs from standard home loans. Here’s how it works:

- Loan Structure

- Homeowners can borrow up to 55% of their home’s appraised value.

- The amount depends on age, home value, and location (Vancouver homes often qualify for higher amounts due to market prices).

- Funds can be received as a lump sum, monthly payouts, or a combination of both.

- Equity Withdrawal

- The loan amount is deducted from the home’s equity over time.

- Since there are no monthly payments, interest accrues and is added to the loan balance.

- Homeowners retain ownership of their property and can live in it as long as they choose.

- Repayment Terms

- The full loan amount plus accumulated interest is repaid when:

- The home is sold.

- The homeowner moves into long-term care.

- The homeowner passes away (in which case, the estate repays the loan).

- Early repayment is allowed, but prepayment fees may apply depending on the lender’s terms.

- The full loan amount plus accumulated interest is repaid when:

Key Differences Between Canadian and U.S. Reverse Mortgages

Many Vancouver seniors hear about reverse mortgages from American sources, leading to confusion. While the general concept is similar, Canadian reverse mortgages are regulated differently and offer distinct protections for homeowners.

| Feature | Canada | United States |

| Minimum Age | 55+ | 62+ |

| Maximum Loan-to-Value (LTV) | Up to 55% | Up to 80% |

| Government-Backed Options | No government-backed reverse mortgages | Yes, the FHA-insured HECM program |

| Lenders | Limited to HomeEquity Bank (CHIP) & Equitable Bank | Multiple lenders with government insurance |

| Loan Repayment Terms | Due when the home is sold or owner passes away | Similar, but more repayment options in the U.S. |

| Homeowner Protections | Borrowers never owe more than their home’s value | Same, but with additional FHA insurance |

Common Misconceptions Among Vancouver Seniors

“I’ll lose my home if I get a reverse mortgage.”

→ False. You remain the homeowner and can stay in your home as long as you meet the loan terms.

“I have to make monthly payments like a regular mortgage.”

→ False. Reverse mortgages don’t require monthly payments, but interest accumulates over time.

“Reverse mortgages are a last-resort option.”

→ False. Many financially stable homeowners use them as a wealth management tool to enhance their retirement.

“I won’t have any money left for my heirs.”

→ Partially True. A reverse mortgage reduces home equity, but in Vancouver’s rising market, property appreciation may offset the loan balance.

Who Qualifies for a Reverse Mortgage in Vancouver?

A reverse mortgage is designed to provide financial flexibility for Vancouver seniors who own their homes. However, not everyone qualifies. Canadian lenders have specific eligibility criteria to ensure that borrowers meet the necessary requirements before accessing home equity.

Below, we break down the minimum age, home equity requirements, and financial considerations for securing a reverse mortgage in Vancouver.

Eligibility Criteria (2025 Update)

To qualify for a reverse mortgage in Canada, you must meet the following requirements:

Minimum Age Requirement (55+ in Canada)

- The primary borrower must be at least 55 years old.

- If you have a spouse or co-owner, they must also be at least 55 to be eligible.

- The older you are, the higher percentage of home equity you can access.

Home Equity and Ownership Conditions

- The property must be fully owned or have a low remaining mortgage balance (which will be paid off using the reverse mortgage funds).

- The amount you can borrow depends on:

- Your age (older borrowers qualify for more funds).

- Your home’s value (higher-value properties can access larger loans).

- The property’s location (Vancouver homes often qualify for larger amounts due to high real estate values).

Financial Assessment Criteria

- Unlike traditional mortgages, income and credit score are NOT primary factors.

- Lenders focus on the home’s value and your age rather than debt-to-income ratio or employment status.

- However, lenders do evaluate:

- Your ability to cover home maintenance and property taxes.

- Your long-term plans for staying in the home.

Which Properties Are Eligible?

Not every home qualifies for a reverse mortgage. In Vancouver, the lender will assess your property type, location, and primary residence status before approving your loan.

Primary Residence Requirement

- The home must be your primary residence (where you live at least six months per year).

- Rental or investment properties do NOT qualify for a reverse mortgage.

Condos vs. Detached Homes in Greater Vancouver

- Detached homes in Vancouver, Burnaby, and surrounding areas often qualify for higher loan amounts due to their high property values.

- Condos and townhouses are eligible, but lenders may be more cautious if the building has strata restrictions or pending major repairs.

- Manufactured homes and leasehold properties (such as some Vancouver condos on leased land) may not be eligible.

Credit Score and Income Requirements

One of the biggest advantages of a reverse mortgage is that no income verification is required, making it a great option for retirees without a steady paycheck.

Why No Income Verification Is Needed

- Unlike a traditional mortgage, a reverse mortgage does not require monthly payments.

- Since lenders don’t need to verify your ability to make payments, they focus on your age and home value instead of income or employment status.

Other Financial Considerations

- Existing Mortgage Balance

- If you still have a mortgage, you must pay it off first using the reverse mortgage funds.

- Property Taxes & Home Insurance

- You must stay up to date on property taxes, home insurance, and maintenance to avoid foreclosure.

- Other Debts

- While your credit score isn’t a major factor, if you have significant outstanding debts, a reverse mortgage might not be the best solution.

How Much Money Can You Get with a Reverse Mortgage in Vancouver?

The amount you can borrow with a reverse mortgage in Vancouver depends on your age, your home’s appraised value, and lender policies. Since real estate prices in Vancouver are among the highest in Canada, many homeowners can unlock significant home equity through a reverse mortgage.

This section breaks down how lenders calculate loan amounts, provides estimated loan values for Vancouver homes, and explains the maximum loan-to-value (LTV) ratio allowed in Canada.

Loan Amount Calculation (How Lenders Decide)

Reverse mortgage lenders in Canada, such as HomeEquity Bank (CHIP Reverse Mortgage) and Equitable Bank, use a risk-based approach to determine how much you can borrow. Here are the key factors:

Home Value Assessment

- The higher your home’s value, the more money you can access.

- A professional home appraisal is required to determine its fair market value.

- Vancouver’s high property values mean local homeowners often qualify for larger loan amounts than those in smaller cities.

Age Factor: Older Borrowers Can Access More Equity

- The older you are, the more home equity you can withdraw.

- This is because lenders assume a shorter repayment timeline, reducing risk.

- Borrowers 55 years old will qualify for less equity than those in their 70s or 80s.

Example Loan Amounts for Vancouver Homes

The following table provides estimated loan amounts based on different home values and borrower ages in Vancouver.

| Home Value | Loan Amount at Age 55 (Approx. 15-25% of Home Value) | Loan Amount at Age 70 (Approx. 30-40% of Home Value) | Loan Amount at Age 85+ (Up to 55% of Home Value) |

| $800,000 | $120,000 – $200,000 | $240,000 – $320,000 | $400,000 – $440,000 |

| $1,000,000 | $150,000 – $250,000 | $300,000 – $400,000 | $500,000 – $550,000 |

| $1,500,000 | $225,000 – $375,000 | $450,000 – $600,000 | $750,000 – $825,000 |

| $2,000,000 | $300,000 – $500,000 | $600,000 – $800,000 | $1,000,000 – $1,100,000 |

Note: These figures are approximate and may vary based on lender policies, interest rates, and individual home conditions.

Maximum Loan-to-Value (LTV) Ratio

In Canada, reverse mortgage lenders cap the loan amount at 55% of the home’s appraised value, even for the oldest borrowers. This policy protects homeowners from excessive debt accumulation and ensures they retain equity in their property.

Why Canadian Lenders Limit Borrowing to 55% of Home Value

- Interest Accumulation: Since no monthly payments are required, interest compounds over time. The 55% cap ensures that homeowners don’t exceed their home’s value.

- Estate Protection: A lower LTV ratio helps ensure that homeowners and their heirs retain some equity in the property.

- Market Fluctuations: In case of real estate downturns, borrowers are less likely to owe more than their home is worth.

Important Note: Unlike in the U.S., where some reverse mortgage programs allow up to 80% LTV, Canadian homeowners can never borrow more than 55% of their home’s value.

Pros and Cons of Reverse Mortgages for Vancouver Seniors

A reverse mortgage can provide financial relief for seniors in Vancouver who want to access their home equity without selling or downsizing. However, like any financial decision, it comes with both advantages and drawbacks.

Below, we outline the key benefits and potential downsides to help you determine whether a reverse mortgage is the right choice for you.

Key Benefits

A reverse mortgage offers several unique advantages, particularly for Vancouver homeowners with substantial home equity.

No Monthly Mortgage Payments

- Unlike a traditional mortgage or home equity loan, you don’t need to make monthly payments.

- The loan is repaid only when you sell the home, move into long-term care, or pass away.

- This makes it an excellent option for seniors who are retired or on a fixed income and want to avoid financial strain.

Stay in Your Home While Accessing Funds

- You retain ownership of your property and can continue living there as long as you meet the lender’s requirements (e.g., keeping up with property taxes and home maintenance).

- Many seniors prefer this option over selling their home or downsizing, especially if they have a strong emotional connection to their residence.

Tax-Free Cash Flow

- The money you receive from a reverse mortgage is not considered taxable income in Canada.

- You can use the funds however you choose:

- Covering daily living expenses

- Paying for in-home care or medical costs

- Renovating your home to improve accessibility

- Helping family members with financial support

Vancouver Advantage: With real estate prices being among the highest in Canada, homeowners can access larger loan amounts compared to seniors in other provinces.

Potential Downsides

While a reverse mortgage can be a powerful financial tool, it’s essential to understand the risks and limitations before making a decision.

High Interest Rates and Compounding Debt

- Reverse mortgage interest rates are higher than traditional mortgage rates.

- Since no payments are made, interest compounds over time, meaning the total debt can grow significantly.

- The longer you stay in the home, the more interest accumulates, reducing the remaining equity in your property.

Reduced Home Equity for Heirs

- A reverse mortgage decreases the amount of inheritance you can leave for your children or beneficiaries.

- Once the home is sold, a significant portion of the proceeds goes toward repaying the loan balance and interest.

- If home prices decline or the loan accumulates too much interest, heirs may receive little to no remaining equity.

Limited Lender Options in Canada

- In the U.S., multiple financial institutions offer reverse mortgages. However, in Canada, only two lenders provide reverse mortgages:

- HomeEquity Bank (CHIP Reverse Mortgage)

- Equitable Bank Reverse Mortgage

- This lack of competition means less flexibility in terms of interest rates, fees, and borrowing conditions.

Alternative Options to Consider: Before committing to a reverse mortgage, explore alternatives like a Home Equity Line of Credit (HELOC), downsizing, or government assistance programs.

How Do You Receive Reverse Mortgage Funds?

Once approved for a reverse mortgage in Vancouver, you can choose how to receive your funds based on your financial needs. Lenders offer different payout structures, including a lump sum, monthly payouts, or a line of credit. Each option has advantages depending on your retirement goals, expenses, and risk tolerance.

This section outlines the available payment methods, the option to use a reverse mortgage as a line of credit, and a comparison of interest rates and costs from Canada’s top reverse mortgage lenders.

Lump Sum vs. Monthly Payouts

Lump Sum: Best for Large, Immediate Expenses

With this option, you receive all your funds upfront in a one-time payment.

Best suited for:

- Paying off an existing mortgage or debts

- Making major home renovations

- Covering unexpected medical expenses

- Providing financial support to family

Pros:

- Immediate access to a large amount of tax-free cash

- No restrictions on how you use the funds

- Ideal if you need to pay off outstanding debts or loans

Cons:

- Higher interest accumulation (since the entire amount starts accruing interest immediately)

- Less flexibility if you need funds spread out over time

Monthly Payouts: Best for Stable, Long-Term Income

Instead of a lump sum, you can receive monthly payments, similar to a pension or annuity.

Best suited for:

- Supplementing retirement income

- Covering day-to-day expenses

- Managing cash flow without overspending

Pros:

- Provides a steady stream of income without affecting government benefits (e.g., OAS, CPP)

- Slower interest accumulation compared to a lump sum

- Ideal for seniors who want financial security over time

Cons:

- Less immediate access to large amounts of money

- Not suitable for seniors who need upfront cash for major expenses

Line of Credit Option

A reverse mortgage line of credit functions similarly to a Home Equity Line of Credit (HELOC), allowing homeowners to withdraw money as needed rather than taking a lump sum or fixed monthly payments.

How It Works

- Borrowers draw funds as needed, only paying interest on the amount used.

- Ideal for unexpected expenses, home repairs, or medical costs.

- Provides maximum flexibility while minimizing interest accumulation.

Pros:

- Only pay interest on what you use, reducing overall borrowing costs

- Greater control over your home equity

- A safety net for unplanned financial needs

Cons:

- Interest rates may be higher than a standard HELOC

- Not all lenders in Canada offer this option

Alternative: If flexibility is your top priority, consider a traditional HELOC instead of a reverse mortgage. However, a HELOC requires monthly payments, while a reverse mortgage does not.

Interest Rates and Costs

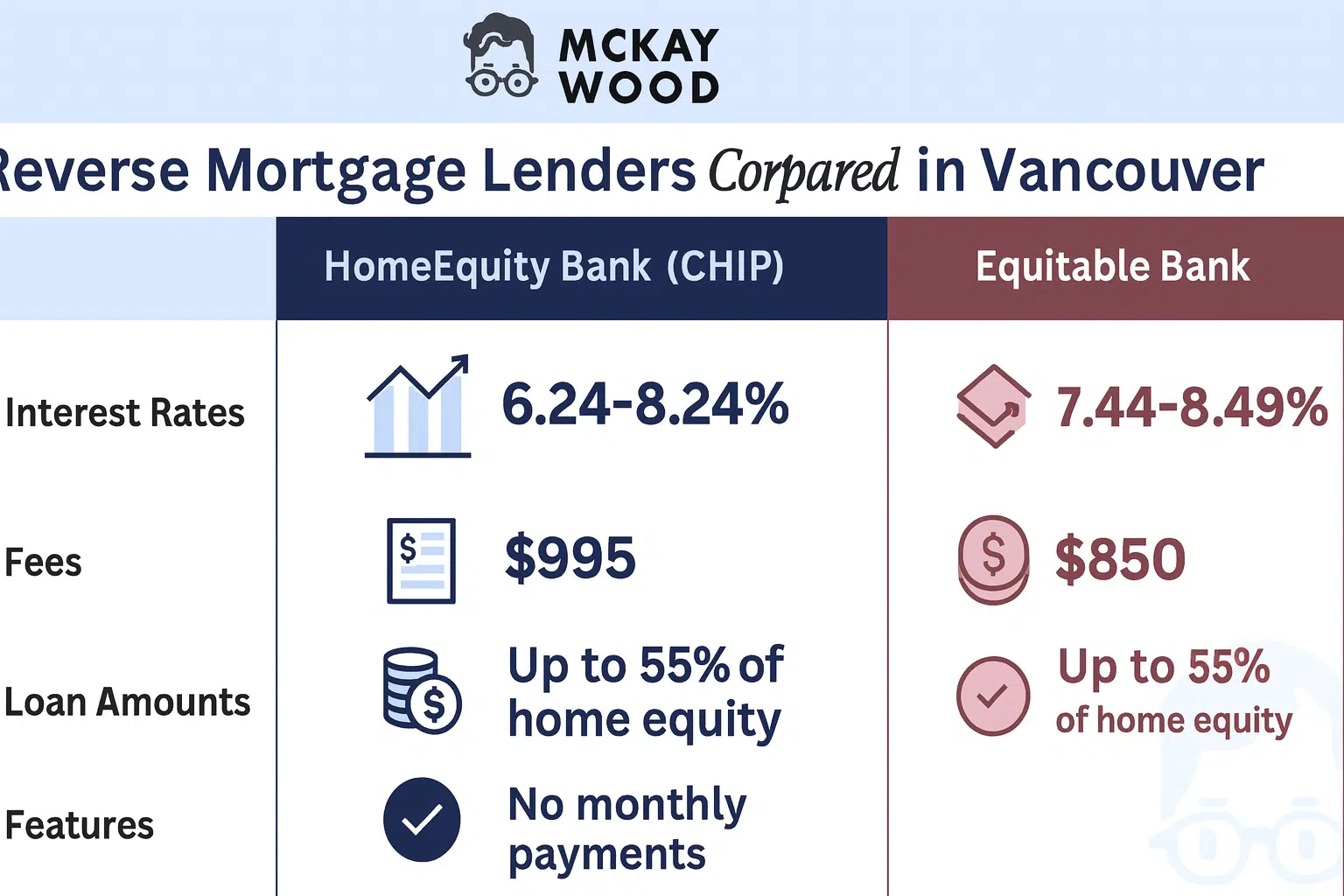

Reverse mortgage interest rates are higher than traditional mortgage rates due to the compounding nature of the loan and the lack of monthly payments. Below is a comparison of rates from Canada’s top reverse mortgage providers:

| Lender | Fixed Rate (5-Year) | Variable Rate | Early Repayment Fees | Administration Fees |

| HomeEquity Bank (CHIP Reverse Mortgage) | 7.99% – 9.49% | 8.49% – 9.99% | Applies if repaid early | $1,795+ |

| Equitable Bank Reverse Mortgage | 7.49% – 8.99% | 7.99% – 9.49% | Applies if repaid early | $995 – $1,795 |

Key Takeaways:

- HomeEquity Bank (CHIP) offers the most widely used reverse mortgage in Canada.

- Equitable Bank tends to offer slightly lower rates and fewer fees.

- Rates vary depending on market conditions and borrower qualifications.

- Additional costs may include legal fees, appraisal fees, and prepayment penalties.

Reverse Mortgage Lenders in Vancouver

Choosing the right reverse mortgage lender is crucial to ensuring you get the best terms, lowest fees, and most flexibility. In Canada, only two major financial institutions offer reverse mortgages—HomeEquity Bank and Equitable Bank.

This section covers the top lenders available in Vancouver and how to compare them based on fees, terms, and customer reviews.

Best Canadian Reverse Mortgage Providers

HomeEquity Bank (CHIP Reverse Mortgage)

Overview:

HomeEquity Bank is the largest and most established reverse mortgage provider in Canada. Their CHIP Reverse Mortgage is available to seniors 55 and older, allowing them to access up to 55% of their home’s value.

Key Features:

- No monthly mortgage payments required

- Tax-free funds available as lump sum, monthly payouts, or line of credit

- Available to homeowners across Greater Vancouver

- Homeowners retain property ownership

Potential Downsides:

- Higher interest rates compared to traditional mortgages

- Early repayment fees if the loan is repaid within the first few years

Best For: Seniors who want a well-established lender with flexible payout options.

Equitable Bank Reverse Mortgage

Overview:

Equitable Bank is a newer player in the reverse mortgage space but offers competitive rates and more flexible payout structures than HomeEquity Bank.

Key Features:

- Slightly lower interest rates compared to CHIP

- Lower administration fees

- Tax-free cash available as a lump sum or scheduled withdrawals

- No credit score or income requirements

Potential Downsides:

- Fewer payout options than CHIP

- Not available for all property types (e.g., leasehold properties)

Best For: Seniors looking for lower fees and interest rates, especially for smaller loan amounts.

How to Choose the Right Lender

When selecting a reverse mortgage provider in Vancouver, it’s important to compare:

Fees, Terms, and Hidden Costs

Before committing to a reverse mortgage, review the full cost breakdown, including:

- Interest Rates: Compare fixed vs. variable rates

- Administration Fees: Typically $995 – $1,795

- Appraisal Fees: Usually $300 – $500

- Early Repayment Penalties: Some lenders charge fees if you repay the loan early

- Legal Fees: Around $1,500 for legal and closing costs

Tip: Get a detailed loan estimate from each lender before making a decision.

Reviewing Customer Experiences in Vancouver

Vancouver seniors who have taken out reverse mortgages report both positive and negative experiences.

Positive Feedback:

- Easy approval process, even for retirees with low or no income

- No impact on Old Age Security (OAS) or Canada Pension Plan (CPP) benefits

- Provides financial stability without having to sell the home

Common Complaints:

- High interest costs—loan balances can grow quickly

- Difficulties repaying early due to penalties

- Limited lender options mean less competitive pricing

Tip: Check online customer reviews, consult a financial advisor, and compare multiple offers before choosing a lender.

What Happens When You Sell Your Home or Pass Away?

A reverse mortgage allows Vancouver seniors to access their home equity while continuing to live in their property. However, since no monthly payments are required, the loan balance grows over time. Eventually, the loan must be repaid when you sell your home, move into long-term care, or pass away.

This section explains how the repayment process works and what happens to your home and estate when the loan comes due.

Repayment Process

A reverse mortgage must be fully repaid when:

- The homeowner sells the home

- The homeowner moves into long-term care for more than 12 months

- The homeowner passes away

At this point, the loan balance—which includes the original loan amount plus accumulated interest—must be settled. Here’s what happens:

If You Sell Your Home

- The proceeds from the sale are used to pay off the reverse mortgage balance.

- Any remaining equity belongs to the homeowner.

- If the home sells for more than the loan balance, the owner or heirs keep the difference.

If You Move Into Long-Term Care

- Some lenders allow a 12-month grace period before requiring full repayment.

- If the borrower does not return home within 12 months, the loan becomes due.

- At that point, the homeowner (or their family) can sell the home or use other funds to settle the loan.

If You Pass Away

- The lender gives a set period (typically 6 months) for the estate to repay the loan.

- The repayment is usually done by selling the home or using other financial assets.

- If the estate needs more time, lenders may grant an extension under certain conditions.

Important: The loan is structured as a non-recourse mortgage, meaning you or your heirs will never owe more than the home’s value, even if the loan balance exceeds the home’s sale price.

Impact on Heirs & Estate Planning

One of the most common concerns among Vancouver seniors is whether their children or heirs can inherit the home after taking out a reverse mortgage.

Can Your Children Inherit the Home?

Yes, but they must repay the reverse mortgage first. They have several options:

Sell the Home

- Use the proceeds to pay off the loan balance.

- Any remaining equity goes to the heirs.

Refinance the Mortgage

- If heirs want to keep the home, they can refinance with a traditional mortgage or use other funds to pay off the reverse mortgage.

Use Other Assets to Repay the Loan

- If the heirs have other financial resources, they can pay off the loan without selling the home.

Key Considerations for Heirs:

- If the home’s value has increased, heirs may still inherit significant equity.

- If the reverse mortgage balance is higher than the home’s value, heirs are not responsible for the shortfall.

- Proper estate planning can help families prepare for the repayment process.

Alternative Options to Reverse Mortgages

While a reverse mortgage is a valuable financial tool for Vancouver seniors, it’s not the only way to access home equity. Some homeowners may benefit more from a Home Equity Line of Credit (HELOC), downsizing, or government assistance programs.

This section explores the key alternatives, comparing their benefits and drawbacks so seniors can make an informed decision.

Home Equity Line of Credit (HELOC) vs. Reverse Mortgage

A Home Equity Line of Credit (HELOC) is another way for Vancouver seniors to borrow against their home’s value, but it works differently from a reverse mortgage.

HELOC: How It Works

- A HELOC allows homeowners to borrow money as needed using their home equity as collateral.

- Borrowers must make monthly interest payments on the amount used.

- Interest rates are lower than a reverse mortgage, but they are variable and can increase.

- Credit approval is required, meaning income and credit score are factors.

Pros of a HELOC for Seniors

- Lower interest rates compared to a reverse mortgage

- Flexibility to borrow only what is needed

- No compounding debt, as interest is paid monthly

Cons of a HELOC for Seniors

- Monthly payments required, which may strain retirees on fixed incomes

- Risk of foreclosure if payments are missed

- Requires income verification, making it harder for seniors to qualify

Best for: Seniors who can afford monthly payments and want a flexible credit option without the long-term cost of a reverse mortgage.

Not ideal for: Retirees with limited income who want a no-payment financing option.

Selling and Downsizing in Vancouver

For seniors who no longer need a large home, downsizing can be a practical alternative to a reverse mortgage. Selling a home in Vancouver’s high-priced real estate market can provide a significant cash payout, allowing seniors to:

- Purchase a smaller, more manageable home

- Move to a senior-friendly community

- Free up cash for retirement, travel, or healthcare

Best Areas for Seniors Looking to Downsize

Condos & Townhomes in Vancouver

- Kitsilano & West End – Walkable communities with access to amenities

- Coal Harbour & Yaletown – Modern condos with low maintenance living

- Mount Pleasant & Main Street – Great for active seniors looking for a vibrant area

Suburban Areas with Affordable Housing

- Burnaby & New Westminster – More affordable condo and townhome options

- Richmond – Lower-density neighborhoods with senior-friendly amenities

- Surrey & Langley – More space for the money, with many 55+ communities

Retirement & 55+ Communities

- South Surrey/White Rock – Quiet, coastal living with senior-focused developments

- Tsawwassen & Ladner – Smaller communities with great access to healthcare

Best for: Seniors looking to unlock equity, reduce housing costs, and live in a more manageable home.

Not ideal for: Seniors who want to stay in their current home long-term.

Government Assistance Programs

Before taking out a reverse mortgage, Vancouver seniors should consider government programs that can help reduce expenses and provide financial relief.

BC Property Tax Deferral Program for Seniors

- Allows homeowners 55+ to defer their property taxes at low interest rates.

- Instead of paying property taxes annually, they are deferred until the home is sold.

- The current interest rate is significantly lower than a reverse mortgage.

- Available for principal residences only (not rental properties).

Best for: Homeowners who need financial relief but don’t want to take on additional debt.

How to Apply: Visit the BC Government website or contact the BC Ministry of Finance to check eligibility.

Common Myths About Reverse Mortgages

Reverse mortgages are often misunderstood, leading to hesitation and misinformation among Vancouver seniors. Below, we debunk some of the most common myths to help you make an informed decision.

“I’ll Lose My Home” – False

Many homeowners fear that taking out a reverse mortgage means giving up ownership of their home. This is completely false.

- You remain the legal owner of your home.

- You can live in your home for as long as you want.

- The loan is only repaid when you sell the home, move into long-term care, or pass away.

Reality: A reverse mortgage is a loan secured against your home, but ownership remains in your name. As long as you keep up with property taxes, insurance, and home maintenance, you can stay in your home without any monthly mortgage payments.

“Reverse Mortgages Are Only for Struggling Seniors” – False

Some people believe that reverse mortgages are a last resort for financially struggling seniors. In reality, many financially secure retirees use them as a smart financial strategy.

- Many seniors use reverse mortgages to supplement their retirement income.

- Some invest the money to grow their wealth.

- Others use it to delay withdrawing from RRSPs and reduce taxes.

Reality: A reverse mortgage can be used strategically for wealth management, not just as a financial safety net.

“It’s a Scam” – False (But Choose Lenders Wisely)

Reverse mortgages are regulated financial products offered by major Canadian banks. However, because of high interest rates and compounding debt, some critics label them as a bad deal or a scam.

- HomeEquity Bank (CHIP Reverse Mortgage) and Equitable Bank are legitimate lenders regulated by Canadian financial authorities.

- Borrowers receive full transparency on loan terms, fees, and interest rates.

- The loan is non-recourse, meaning you or your heirs will never owe more than the home’s value.

Reality: Reverse mortgages are not scams, but it’s crucial to review all terms carefully and compare lenders before committing. Consulting a financial advisor can help ensure it’s the right choice for you.

How to Apply for a Reverse Mortgage in Vancouver

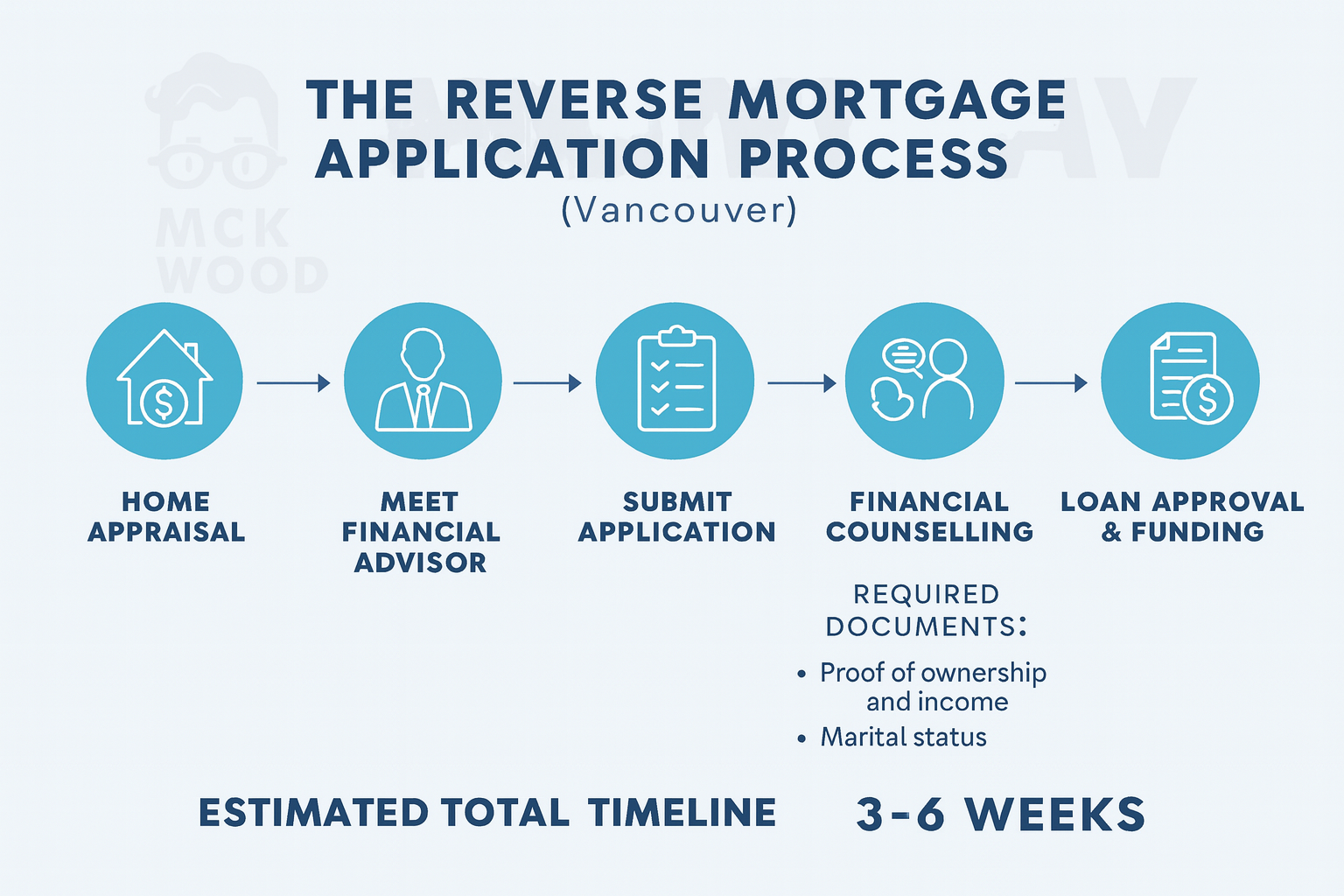

Applying for a reverse mortgage is a straightforward process, but it’s important to understand the requirements, necessary documents, and approval timeline.

Step-by-Step Application Process

Get a Home Appraisal

- Lenders require a professional home appraisal to determine your home’s value.

- The amount you qualify for depends on age, home value, and location.

Meet with a Financial Advisor (Optional, but Recommended)

- Discuss how a reverse mortgage fits into your overall retirement plan.

- Consider alternatives like a HELOC or downsizing.

Submit Your Application

- Apply through HomeEquity Bank (CHIP Reverse Mortgage) or Equitable Bank.

- The lender will review your eligibility and financial situation.

Undergo Financial Counseling (Required by Some Lenders)

- Some lenders may require independent legal or financial advice before approving the loan.

Loan Approval & Funding

- Approval typically takes 2-4 weeks, depending on the lender.

- Once approved, funds are disbursed as a lump sum, monthly payments, or a line of credit.

Timeline: The entire process, from application to funding, usually takes 3-6 weeks.

Documents You Need

To apply for a reverse mortgage, you’ll need the following:

Proof of Home Ownership

- A property title document showing you own the home.

Age Verification

- A government-issued ID (e.g., driver’s license, passport) to confirm you’re 55 or older.

Property Details

- A recent home appraisal or assessment.

Mortgage Information (If Applicable)

- If you have an existing mortgage, the reverse mortgage funds will first be used to pay it off.

Tip: Having these documents ready can speed up the approval process.

Consultation with a Financial Advisor

Before committing to a reverse mortgage, it’s highly recommended to speak with a financial advisor or mortgage specialist.

- They can analyze your financial situation and suggest alternative options if needed.

- A financial expert can help you compare lenders and negotiate better terms.

- They can review the long-term impact of a reverse mortgage on your estate and heirs.

Final Tip: A reverse mortgage is a long-term commitment, so professional guidance can help ensure it aligns with your retirement goals.

Conclusion: Is a Reverse Mortgage Right for You?

A reverse mortgage can be a powerful financial tool for Vancouver seniors looking to access their home equity while remaining in their homes. However, it’s not the right choice for everyone. Understanding your financial goals, lifestyle needs, and long-term plans will help determine whether this option is the best fit for you.

Below, we break down how to weigh the pros and cons, identify ideal scenarios, and take the next steps toward making an informed decision.

Weighing the Pros and Cons for Your Situation

Before committing to a reverse mortgage, consider the long-term financial implications. Here’s a quick breakdown of when a reverse mortgage could work for you—and when it might not.

A reverse mortgage might be right for you if:

- You want to stay in your home and maintain financial independence.

- You need tax-free funds for living expenses, healthcare, or home renovations.

- You’re not concerned about leaving a large inheritance to your heirs.

- You don’t want the burden of monthly loan payments.

A reverse mortgage might NOT be right for you if:

- You plan to move in the near future (since early repayment fees may apply).

- You want to maximize your home equity for your heirs.

- You qualify for a Home Equity Line of Credit (HELOC) and can handle monthly payments.

- You’re considering downsizing as a way to unlock home equity.

Key Takeaway: Reverse mortgages provide financial flexibility, but they come with higher interest costs and reduced home equity over time. Always compare options before making a final decision.

When a Reverse Mortgage Makes Sense

A reverse mortgage is particularly beneficial for certain groups of seniors in Vancouver. If you fall into one of the categories below, this option might be worth exploring.

Who Benefits the Most?

Seniors with significant home equity but limited cash flow

- If you own your home outright (or have a low mortgage balance), a reverse mortgage can free up much-needed funds for retirement.

Homeowners who want to age in place

- If you prefer staying in your home rather than selling or downsizing, a reverse mortgage allows you to remain in your community.

Retirees looking to supplement pension income

- If your CPP, OAS, and RRSP withdrawals aren’t enough, a reverse mortgage can provide extra financial stability.

Those who don’t qualify for traditional loans or HELOCs

- Reverse mortgages do not require income or credit score verification, making them accessible to seniors who might not qualify for other lending options.

Key Takeaway: A reverse mortgage is best for seniors who plan to stay in their home long-term and need additional retirement income without the burden of monthly payments.

Next Steps

If you’re considering a reverse mortgage, here’s what you should do next:

Step 1: Speak with a Financial Advisor

- Get professional guidance to see if a reverse mortgage aligns with your financial goals.

- Review alternative options, such as a HELOC, downsizing, or government assistance programs.

Step 2: Compare Vancouver-Based Lenders

- Get quotes from HomeEquity Bank (CHIP) and Equitable Bank to compare interest rates, fees, and loan terms.

- Ask about early repayment penalties, administration fees, and payout options.

Step 3: Explore Alternative Solutions If Needed

- Check if you qualify for BC’s Property Tax Deferral Program to reduce expenses.

- Consider downsizing to a smaller home, condo, or 55+ community.

- If you can afford monthly payments, explore a HELOC as a lower-cost borrowing option.

Final Tip: Do your research, compare lenders, and consult an expert before signing any agreement. A reverse mortgage is a long-term commitment that should align with your retirement strategy.

FAQs

1. Can I still leave my home to my children if I have a reverse mortgage?

Yes. However, your children must repay the loan balance when you pass away. They can do this by:

- Selling the home and using the proceeds to pay off the loan.

- Refinancing the mortgage in their name if they wish to keep the home.

If the home’s value is higher than the loan balance, they keep the remaining equity.

2. What fees should I expect when getting a reverse mortgage in Vancouver?

Reverse mortgages come with various fees, including:

- Home appraisal fee: $300 – $500

- Legal & closing costs: $1,500+

- Administration fee: $995 – $1,795

- Early repayment penalty: Varies by lender

Interest rates are typically higher than traditional mortgages, compounding over time.

3. What happens if I move into a care home—do I have to repay the loan?

Yes. If you move into a care facility for more than 12 months, the loan becomes due for repayment. Options include:

- Selling the home to repay the balance.

- Using other financial resources to pay off the loan.

Lenders typically offer a 6 to 12-month grace period to allow time for repayment.

4. Can I get a reverse mortgage on a condo in downtown Vancouver?

Yes, but the condo must meet lender requirements:

- It must be your primary residence.

- It must be a freehold property (not leasehold).

- Some lenders may restrict loans for condos in high-risk or high-turnover buildings.

It’s best to check with HomeEquity Bank or Equitable Bank for eligibility before applying.

5. How do I compare reverse mortgage lenders in Canada effectively?

To get the best deal, compare:

- Interest rates (fixed vs. variable)

- Loan terms and repayment flexibility

- Upfront and ongoing fees

- Customer reviews and lender reputation

Consider speaking to a mortgage broker or financial advisor to find the best lender for your situation.