As home prices in Vancouver continue to rise, many seniors find themselves asset-rich but cash-poor. A reverse mortgage offers a way to tap into home equity without selling the property, providing financial relief while allowing homeowners to stay in their residences. However, like any financial product, it comes with both advantages and drawbacks that must be carefully weighed.

In this guide, we’ll break down the key aspects of reverse mortgages in Vancouver, how they work in Canada, who qualifies, and what you need to consider before making a decision.

Understanding Reverse Mortgages in Vancouver

A reverse mortgage is a unique financial tool tailored for homeowners aged 55 and older who want to unlock the equity in their home while continuing to live in it. While it provides financial flexibility, it’s important to understand how it works and whether it aligns with your long-term financial goals.

What is a Reverse Mortgage?

A reverse mortgage is a secured loan that allows homeowners to convert a portion of their home equity into tax-free cash. Unlike a traditional mortgage, where borrowers make regular payments to the lender, a reverse mortgage works the opposite way—the lender provides payments to the homeowner, and the loan balance increases over time.

Key features of a reverse mortgage:

- No monthly payments required

- The loan is repaid when the homeowner sells the home, moves out, or passes away

- Homeowners remain the legal owners of the property

- The amount received depends on the home’s value, the borrower’s age, and the lender’s policies

How Does a Reverse Mortgage Work in Canada?

Reverse mortgages in Canada are regulated and only offered by a few lenders, including HomeEquity Bank (CHIP Reverse Mortgage) and Equitable Bank. The process works as follows:

- Eligibility Assessment:

- The homeowner must be 55 years or older (both spouses if applicable).

- The home must be the primary residence (not a rental or vacation home).

- The property must be in Canada and meet the lender’s appraisal standards.

- Loan Amount Calculation:

- The maximum loan amount is up to 55% of the home’s appraised value.

- Factors include age, home location, condition, and market trends.

- Receiving Funds:

- Funds can be received as a lump sum, scheduled payments, or a combination of both.

- The money is tax-free and does not affect OAS (Old Age Security) or GIS (Guaranteed Income Supplement) benefits.

- Interest Accumulation:

- Interest is added to the loan balance, compounding over time.

- Since payments aren’t required, the debt grows, reducing home equity over time.

- Loan Repayment:

- The loan must be repaid when the homeowner sells, moves into long-term care, or passes away.

- Typically, the home is sold to cover the balance, with any remaining equity going to the homeowner’s estate.

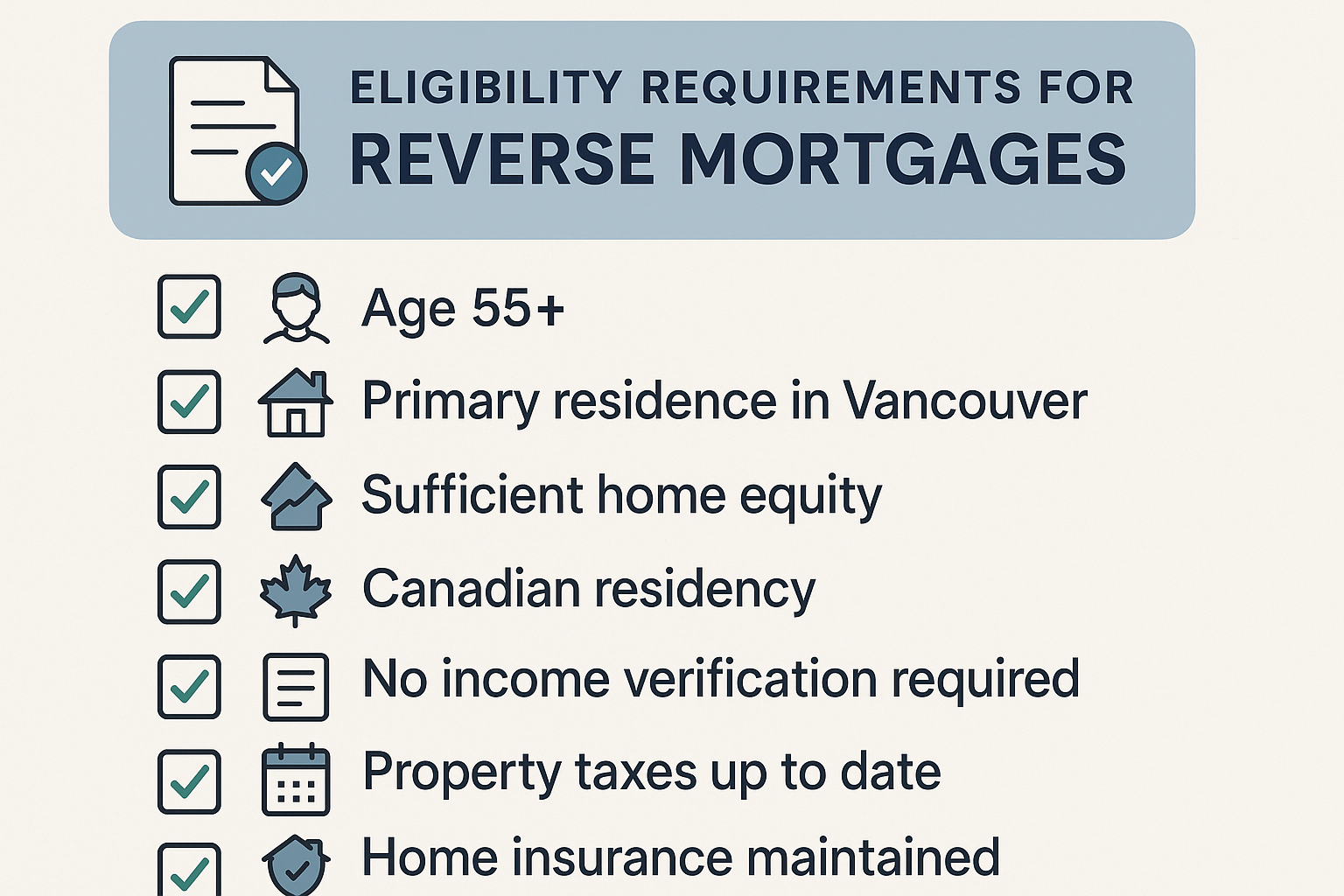

Who is Eligible for a Reverse Mortgage in Vancouver?

To qualify for a reverse mortgage in Vancouver, you must meet specific eligibility criteria set by Canadian lenders:

- Age Requirement: At least 55 years old (both homeowners if applicable)

- Homeownership: Must own and reside in the property as a primary residence

- Property Type: The home must be a detached house, townhouse, or condo (some lenders may have restrictions on certain properties)

- Equity Requirement: The amount you can borrow depends on your home’s appraised value, location, and age

- No Income or Credit Check Required: Since no monthly payments are necessary, lenders do not require proof of income or a high credit score

Vancouver’s high home values make reverse mortgages an attractive option for seniors who need access to cash but want to remain in their homes. However, with interest rates and fees to consider, it’s crucial to assess whether this option is right for you.

The Pros of a Reverse Mortgage

A reverse mortgage can be a valuable financial tool for Vancouver homeowners who need additional funds while continuing to live in their homes. Given the city’s high real estate values, many seniors have significant home equity but limited access to liquid cash. A reverse mortgage allows them to tap into their home’s value without selling.

Here are the key benefits of a reverse mortgage in Vancouver:

Access to Tax-Free Cash Without Selling Your Home

One of the biggest advantages of a reverse mortgage is the ability to access your home equity as tax-free cash. Unlike withdrawals from RRSPs or other taxable investments, the money you receive from a reverse mortgage is not considered income by the Canada Revenue Agency (CRA).

- No impact on your taxable income (keeps OAS and GIS benefits intact)

- Avoid selling your home to unlock equity

- Receive a lump sum or regular payments, depending on your needs

This can be especially beneficial for retirees on a fixed income who need extra funds for daily expenses, home renovations, or unexpected medical costs.

No Monthly Mortgage Payments Required

With a traditional mortgage or home equity line of credit (HELOC), borrowers must make regular monthly payments. A reverse mortgage, however, does not require any monthly payments—the loan is repaid only when you move out or sell the home.

- Reduces financial stress by eliminating monthly payments

- Ideal for retirees on fixed incomes who want to free up cash flow

- Interest is added to the loan balance instead of being paid monthly

This makes reverse mortgages a popular option for seniors who want to supplement their income without increasing their financial burden.

Retain Homeownership and Live in Your Home Longer

A common misconception about reverse mortgages is that the bank takes ownership of the home. This is not true—you remain the legal homeowner and can continue living in your home as long as you meet the loan conditions.

- Stay in your home without pressure to move

- No need to downsize or rent if you prefer to age in place

- You can still sell your home whenever you choose (but the loan must be repaid)

For seniors who love their neighborhood, have strong community ties, or want to avoid the stress of moving, a reverse mortgage provides a way to remain in their home without financial strain.

Flexibility in How You Use the Funds

Unlike some financial products with restrictions on how you use the money, a reverse mortgage provides full control over the funds. You can use the cash for any purpose, such as:

- Covering daily living expenses (food, utilities, insurance)

- Home repairs and modifications (installing a stairlift, upgrading bathrooms)

- Medical expenses and home care (hiring caregivers, private healthcare)

- Travel or lifestyle improvements (visiting family, enjoying retirement)

- Helping family members financially (assisting children with home purchases)

This financial flexibility allows homeowners to customize their retirement plan based on their unique needs and priorities.

Protection Against Market Downturns

One of the lesser-known benefits of a reverse mortgage is the built-in protection against declining home values. In Canada, reverse mortgages have a no negative equity guarantee, meaning:

- You will never owe more than your home’s value when it’s sold

- If home prices drop, your heirs won’t be responsible for extra debt

- If the loan balance exceeds the sale price, the lender absorbs the loss

Given Vancouver’s historically high real estate values, homeowners benefit from long-term property appreciation while having financial security in case of unexpected market changes.

The Cons of a Reverse Mortgage

While a reverse mortgage can provide financial relief and flexibility for Vancouver homeowners, it also comes with significant drawbacks. Higher interest rates, reduced home equity, and potential impacts on inheritance are some of the key concerns. Before applying, it’s essential to weigh these factors carefully.

Higher Interest Rates Compared to Traditional Mortgages

Reverse mortgages tend to have higher interest rates than conventional home loans, making them more expensive over time. This is because:

- No monthly payments are required, so interest accumulates and compounds

- Lenders take on more risk, knowing repayment happens only when the home is sold

- Limited competition in Canada means fewer lenders and less rate variation

In Canada, reverse mortgage interest rates are typically 2-3% higher than standard mortgage rates. Over time, this can substantially increase the loan balance.

Tip: If you only need short-term financial support, consider a HELOC (Home Equity Line of Credit) instead, as it usually offers lower interest rates and more flexibility.

Home Equity Decreases Over Time

One of the biggest concerns with a reverse mortgage is that your home equity shrinks as interest accumulates. Since you’re not making payments, the loan balance grows each year, reducing the amount of equity left in your home.

Home appreciation vs. loan growth: If property values increase faster than your loan balance, you may retain some equity. However, if the loan grows too quickly, there may be little to no equity left when the home is sold.

This is particularly risky if you were hoping to leave your home as an inheritance or use your equity for future financial needs.

Tip: If preserving home equity is important, explore options like downsizing or setting up a partial HELOC alongside a smaller reverse mortgage.

Potential Impact on Inheritance for Your Heirs

Since a reverse mortgage reduces home equity, it directly affects the inheritance left for your family. Upon your passing, the loan must be repaid, usually by selling the home. If the loan balance is high, your heirs may receive little to no proceeds from the sale.

Things to consider:

- Heirs may have to sell the home to cover the loan balance

- Less wealth is passed down to children or grandchildren

- If they wish to keep the home, they must find a way to pay off the loan (e.g., personal savings or refinancing)

Tip: Discuss your plans with family members before applying to ensure everyone understands the long-term financial impact.

Additional Fees and Penalties

Beyond interest, reverse mortgages come with various fees that can increase borrowing costs, including:

- Setup and closing fees: Appraisal fees, legal fees, and administrative costs

- Early repayment penalties: If you pay off the loan before a certain period, you could face penalty charges

- Discharge fees: Costs associated with paying off the loan if you decide to sell your home early

Since these fees can add up, it’s essential to get a full breakdown of costs from your lender before committing.

Tip: Always compare costs between reverse mortgage lenders and other financial options before deciding.

Limited Lender Options in Canada

Unlike in the U.S., where multiple lenders offer reverse mortgages, Canada has very few providers:

- HomeEquity Bank (CHIP Reverse Mortgage) – The largest and most well-known lender in Canada

- Equitable Bank Reverse Mortgage – Available in select regions with slightly different terms

This lack of competition means:

- Fewer choices when it comes to interest rates and loan terms

- Less flexibility in structuring your reverse mortgage

- Minimal room for negotiation on fees and conditions

Tip: Before applying, consult with a financial advisor to explore other options like HELOCs, private lending, or downsizing.

Key Considerations Before Getting a Reverse Mortgage

A reverse mortgage can be a useful financial tool for Vancouver homeowners, but it’s not the right solution for everyone. Before making a decision, it’s essential to understand the terms, costs, long-term implications, and alternative options. Below are the key factors you should evaluate before committing to a reverse mortgage.

Understanding Loan Terms and Interest Rates

Reverse mortgages in Canada have different terms, conditions, and repayment structures compared to traditional mortgages. Since the interest accumulates over time, understanding the loan terms is critical.

Key factors to consider:

- Interest rates: Reverse mortgage rates are typically higher than conventional mortgage rates (2-3% higher on average). The longer you keep the loan, the more the

- compounding interest increases the total balance.

- Maximum loan amount: In Canada, you can borrow up to 55% of your home’s value, depending on your age, property location, and lender.

- Repayment conditions: The loan must be repaid when you sell the home, move out permanently, or pass away. If you decide to repay early, penalties may apply.

Tip: Ask your lender for a detailed loan estimate, including the projected loan balance over time, to understand the long-term cost of borrowing.

Impact on Government Benefits (OAS, GIS, etc.)

One of the key advantages of a reverse mortgage is that the money you receive is not considered taxable income. However, it may still impact some government benefits.

How a reverse mortgage affects benefits:

- Old Age Security (OAS): Since OAS is not income-tested, your payments will not be affected by a reverse mortgage.

- Guaranteed Income Supplement (GIS): Because GIS is income-based, a reverse mortgage does not count as income and should not reduce your GIS eligibility.

- Provincial assistance programs: Some low-income homeowner programs may take home equity into account when determining eligibility.

Tip: Speak with a financial advisor or government representative to confirm how a reverse mortgage might impact your specific benefits.

Long-Term Financial Planning and Exit Strategy

A reverse mortgage is a long-term financial commitment. While it provides immediate cash, it reduces home equity over time, which can impact your future financial security.

What to consider for long-term planning:

- Future housing needs: If you anticipate moving into assisted living or downsizing in a few years, a reverse mortgage might not be the best option due to early repayment penalties.

- Loan balance growth: Since interest compounds, the longer you hold the loan, the less equity remains for future needs or inheritance.

- Estate planning: If passing your home to your heirs is important, you should evaluate whether a reverse mortgage aligns with your estate goals.

Tip: Work with an estate planner or financial advisor to determine whether a reverse mortgage fits within your overall retirement strategy.

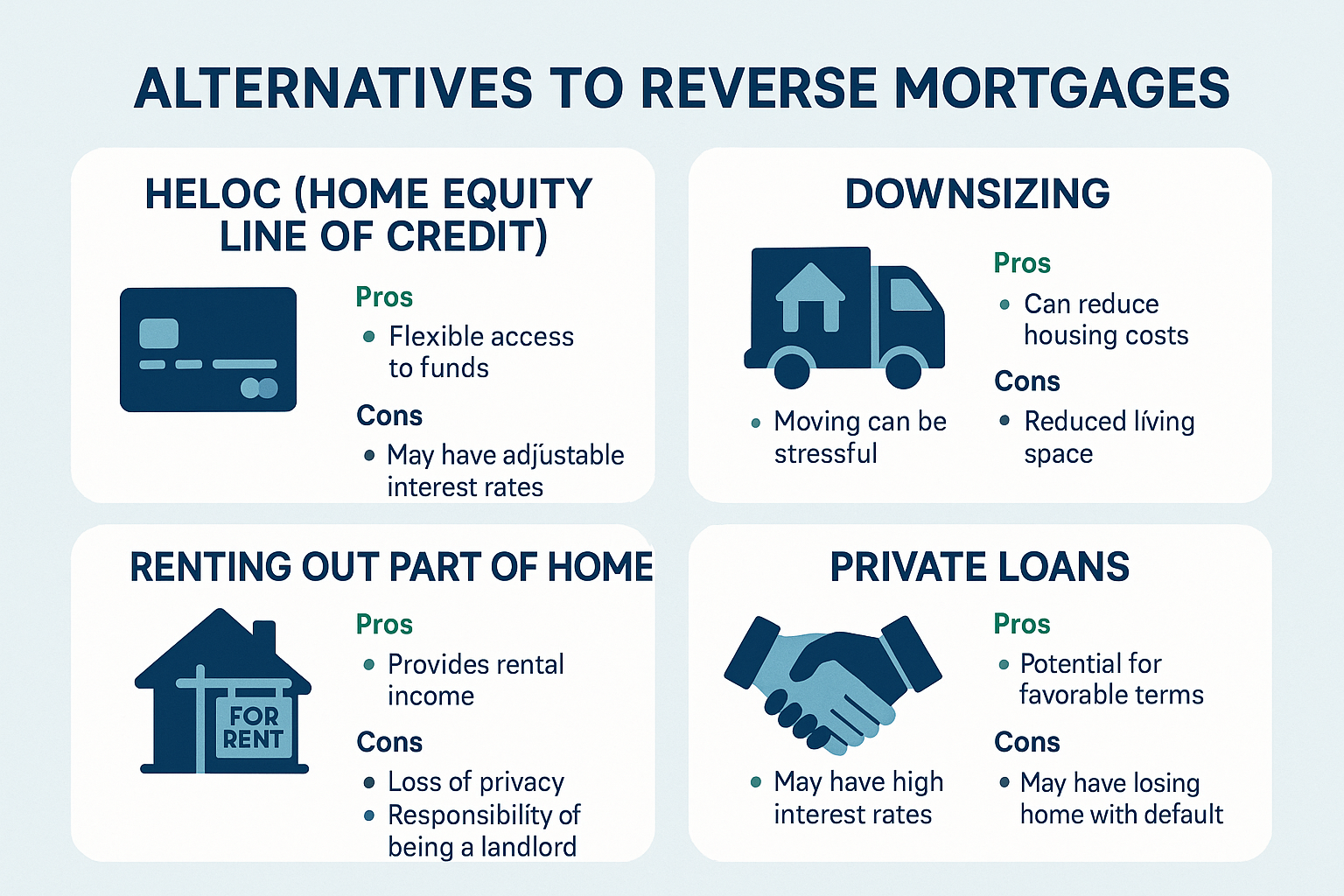

Comparing Reverse Mortgages to Other Financial Options

Before choosing a reverse mortgage, compare it with other home equity and retirement funding options that may be more cost-effective.

1. Home Equity Line of Credit (HELOC) vs. Reverse Mortgage

- Lower interest rates than a reverse mortgage

- Can withdraw funds as needed (flexibility)

- Requires monthly payments (unlike a reverse mortgage)

- Difficult to qualify for if you have a low income or poor credit

2. Downsizing: Selling Your Home Instead

- Provides a large lump sum of cash

- Eliminates mortgage debt completely

- May allow you to move to a lower-maintenance property

- Requires moving, which some homeowners prefer to avoid

3. Renting Out Part of Your Home

- Provides regular monthly income

- Helps cover living expenses without reducing home equity

- Allows you to stay in your home

- May not be feasible if you don’t want tenants

4. Private Loans and Other Senior-Friendly Options

- Some lenders offer private home equity loans with more flexible terms

- May allow for better control over repayment

- Typically higher interest rates than a traditional mortgage

Tip: Before deciding, consult with a mortgage broker or financial expert to compare these options and determine the best choice based on your financial goals.

Reverse Mortgage vs. Other Financial Alternatives

A reverse mortgage is not the only way for Vancouver homeowners to access home equity. Depending on your financial situation, you may want to explore alternative options that provide liquidity while maintaining greater control over your finances. Below, we compare a reverse mortgage with other popular alternatives: a home equity line of credit (HELOC), downsizing, renting out part of your home, and private loans.

Home Equity Line of Credit (HELOC) vs. Reverse Mortgage

A Home Equity Line of Credit (HELOC) is a revolving credit line secured against your home. Unlike a reverse mortgage, where the loan balance grows over time, a HELOC allows you to borrow only what you need and make payments on the balance.

Key Differences:

| Feature | HELOC | Reverse Mortgage |

| Monthly Payments | Required | No monthly payments |

| Access to Funds | Borrow as needed | Lump sum or scheduled payments |

| Interest Rates | Lower (variable rates) | Higher (compounding) |

| Credit Check Required? | Yes | No |

| Repayment | Ongoing payments | Due when you sell/move/pass away |

When to Choose a HELOC:

- You have a steady income and can afford monthly payments

- You want flexibility to borrow only what you need

- You prefer lower interest rates than a reverse mortgage

When to Choose a Reverse Mortgage:

- You don’t qualify for a HELOC due to low income or bad credit

- You don’t want monthly payments affecting your cash flow

- You plan to stay in your home for the long term

Tip: If you qualify, a HELOC is often a more cost-effective option than a reverse mortgage due to lower interest rates and better flexibility.

Downsizing: Selling Your Home Instead

For many Vancouver homeowners, downsizing is a practical alternative to a reverse mortgage. By selling your home and moving to a smaller property or a lower-cost area, you can unlock your home equity without taking on debt.

Pros of Downsizing:

- Provides a large lump sum of cash

- Eliminates mortgage debt and home maintenance costs

- Offers more manageable living space in retirement

Cons of Downsizing:

- Emotional attachment—many seniors prefer to stay in their current home

- Moving costs (real estate fees, legal fees, moving expenses)

- Housing prices—finding an affordable home in Vancouver can be challenging

Tip: Downsizing is an excellent option for seniors who want to reduce expenses and maintain financial independence without taking on additional debt.

Renting Out Part of Your Home as an Alternative

If you need additional income but want to keep your home, renting out part of your property (such as a basement suite, spare bedroom, or laneway house) can be a viable alternative to a reverse mortgage.

Pros of Renting Out Your Home:

- Provides a steady stream of monthly income

- Helps cover living expenses without taking on debt

- Can be done short-term (Airbnb) or long-term (tenants)

Cons of Renting Out Your Home:

- Requires management and responsibility (finding tenants, maintaining the space)

- Privacy concerns—some homeowners may not want to share their living space

- Rental laws in Vancouver can be strict (short-term rental restrictions, tenant rights)

Tip: If you have extra space and are comfortable with tenants, this is an excellent way to generate passive income without reducing your home equity.

Private Loans and Other Senior-Friendly Options

Some seniors may qualify for private loans or alternative lending programs that provide access to cash without the high costs of a reverse mortgage.

Options to Consider:

- Private Home Equity Loans – Similar to a HELOC but offered by private lenders with more flexible requirements

- Government Assistance Programs – Vancouver offers property tax deferral programs for seniors, which can help with expenses

- Family Loans – Some seniors opt to borrow money from family members instead of taking out a reverse mortgage

Pros of Private Loans & Other Alternatives:

- More flexible borrowing options than a reverse mortgage

- Can provide lower interest rates depending on the lender

- Some government programs offer interest-free options

Cons of Private Loans & Other Alternatives:

- Private loans may have higher interest rates than traditional bank loans

- Borrowing from family can create financial strain and relationship issues

- Not all seniors qualify for government assistance programs

Tip: Before taking out a reverse mortgage, explore all possible alternatives to find the most cost-effective and flexible solution.

Reverse Mortgage Lenders in Vancouver

Since reverse mortgages are not as widely available as traditional home loans in Canada, Vancouver homeowners have limited lender options. However, it’s crucial to understand which providers operate in the market, how to compare their offers, and what steps to take when applying.

Overview of Major Reverse Mortgage Providers in Canada

In Canada, there are two main financial institutions offering reverse mortgages:

1. HomeEquity Bank – CHIP Reverse Mortgage

HomeEquity Bank is the most well-known reverse mortgage provider in Canada, offering the CHIP Reverse Mortgage.

- Available across Vancouver and the rest of Canada

- Provides up to 55% of the home’s value

- Offers flexible lump sum, scheduled payments, or a combination

- Includes a no negative equity guarantee, ensuring you never owe more than the home’s value

2. Equitable Bank Reverse Mortgage

Equitable Bank is the only other major provider, but their reverse mortgage is more regionally limited.

- Available in select regions (check if they operate in Vancouver)

- Offers flexible repayment options and no required monthly payments

- Interest rates are competitive but vary by lender and location

Other Alternative Lenders

Although HomeEquity Bank and Equitable Bank are the only major reverse mortgage providers, some private lenders and credit unions may offer home equity loans or other financing options that serve as alternatives.

Tip: Always check with a mortgage broker or financial advisor to explore all options before committing.

How to Compare Interest Rates and Fees

Reverse mortgages typically have higher interest rates than traditional mortgages or HELOCs, so it’s essential to compare rates, fees, and overall costs before choosing a lender.

Key Factors to Compare:

- Interest Rates: Reverse mortgage interest rates are 2-3% higher than traditional mortgages and vary between fixed and variable rates.

- Loan Amount: Lenders allow borrowing up to 55% of home value, but the exact percentage depends on your age, property type, and location.

- Setup and Closing Fees: Expect costs for:

- Home appraisal ($300-$500)

- Legal fees ($1,000-$2,000)

- Administrative fees ($1,000-$1,800)

- Prepayment Penalties: Some lenders charge penalties for early repayment if you decide to pay off the loan ahead of time.

- Payout Options: Choose between a lump sum, monthly installments, or a combination—each option affects how interest accumulates.

Tip: Always get a loan estimate from multiple providers to compare total costs over time, not just upfront fees.

Steps to Apply for a Reverse Mortgage in Vancouver

Applying for a reverse mortgage in Vancouver involves several key steps, from determining eligibility to finalizing the loan. Here’s how the process works:

Step 1: Check Your Eligibility

- You must be 55 years or older (if you have a spouse, both must be 55+)

- You must own and live in your home as a primary residence

- Your home must be in good condition and meet lender appraisal standards

- You can borrow up to 55% of your home’s value, depending on age and location

Step 2: Get a Home Appraisal

- A professional home appraisal is required to determine your property’s market value.

- Costs typically range from $300 to $500, and the lender arranges the appraisal.

Step 3: Compare Offers and Loan Terms

- Get quotes from both HomeEquity Bank (CHIP) and Equitable Bank.

- Compare interest rates, payout structures, fees, and repayment terms.

- Consult with a financial advisor or mortgage broker before signing any agreement.

Step 4: Legal Review and Approval

- Canadian law requires you to receive independent legal advice before finalizing a reverse mortgage.

- Work with a lawyer or notary to review the loan agreement.

Step 5: Receive Your Funds

Once approved, you can choose to receive the money as:

- A lump sum

- Scheduled monthly payments

- A combination of both

Step 6: Loan Repayment

- No monthly payments are required, but the loan must be repaid when you move, sell the home, or pass away.

- The final repayment amount includes the loan principal, accumulated interest, and any fees.

Tip: Always plan for long-term financial impacts—consider whether you may need to move or downsize in the future.

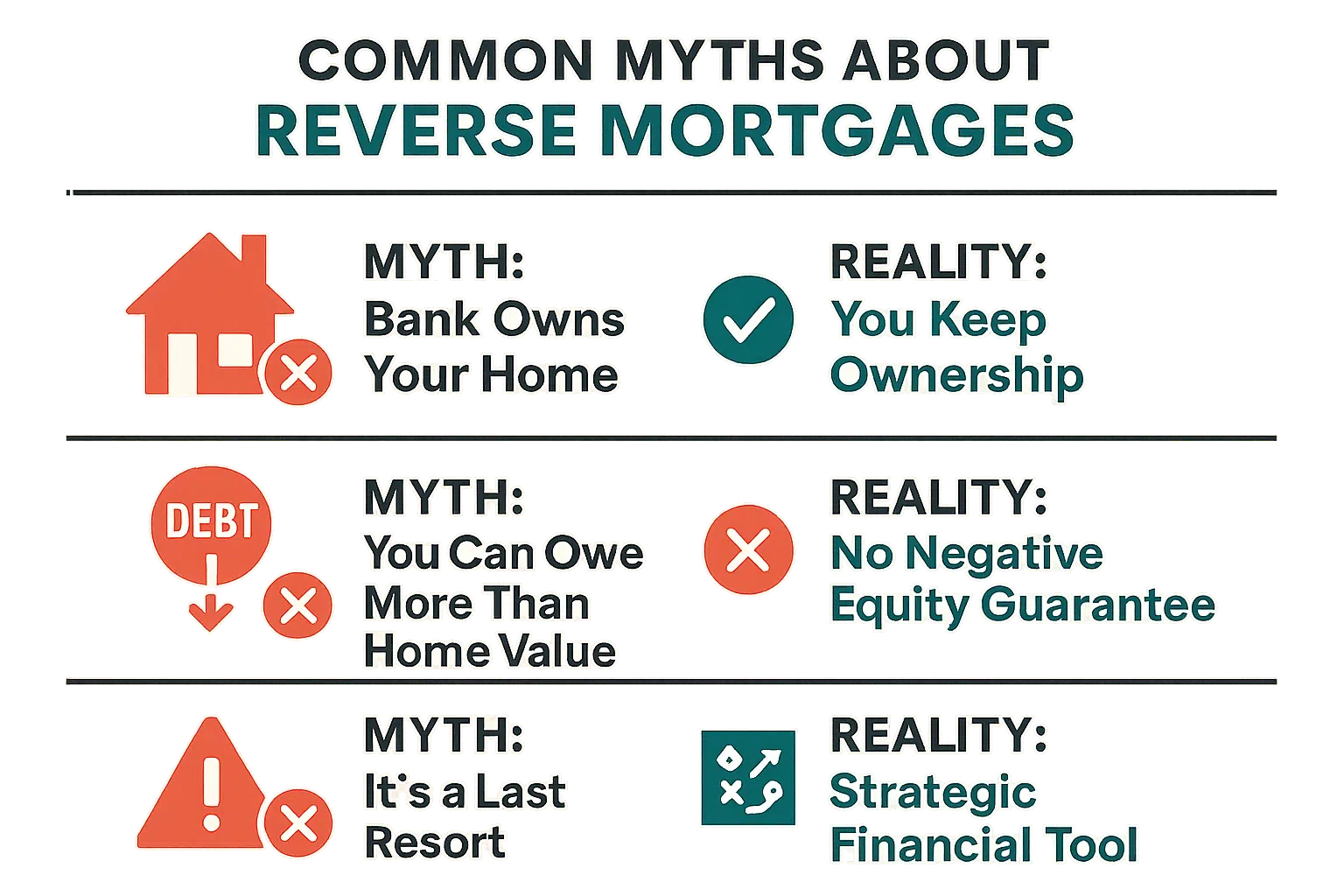

Common Myths and Misconceptions About Reverse Mortgages

Reverse mortgages are often misunderstood, leading to hesitation and confusion among Vancouver homeowners. While they offer financial flexibility, misinformation can prevent people from making informed decisions. Below, we debunk three of the most common myths surrounding reverse mortgages.

Myth #1: The Bank Owns Your Home

Reality: You retain full ownership of your home when you take out a reverse mortgage.

One of the most persistent myths is that lenders take ownership of your home when you get a reverse mortgage. In reality, you remain the legal owner and can continue living in your home for as long as you want, provided you meet the loan terms.

What’s required to keep ownership?

- You must keep up with property taxes, home insurance, and maintenance

- You cannot default on the loan conditions (e.g., leaving the home for an extended period)

- You can sell your home anytime and use the proceeds to repay the loan

Fact Check: The lender places a lien on the property (similar to a traditional mortgage), meaning they have the right to be repaid when the home is sold. However, they do not take ownership of the home.

Tip: If you’re concerned about keeping your home for the long term, ensure that you fully understand the lender’s terms and conditions before signing.

Myth #2: You Can Owe More Than Your Home is Worth

Reality: Canadian reverse mortgages come with a “No Negative Equity Guarantee”, meaning you will never owe more than your home’s value when it’s sold.

A common fear is that reverse mortgage debt can spiral out of control, leaving homeowners or their heirs with more debt than the home is worth. However, Canadian lenders, including HomeEquity Bank and Equitable Bank, have built-in protections.

How the “No Negative Equity Guarantee” Works:

- If your home sells for less than the loan balance, the lender absorbs the loss—not you or your family.

- Reverse mortgages are regulated to prevent over-lending, with a cap of 55% of home value.

- If property values drop, the guarantee ensures heirs won’t inherit debt.

Fact Check: Even if home prices fall, you or your estate will never be forced to pay more than the home’s final sale price.

Tip: If preserving home equity for your heirs is important, consider alternative options like a Home Equity Line of Credit (HELOC) or downsizing before committing to a reverse mortgage.

Myth #3: Reverse Mortgages Are a Last Resort

Reality: A reverse mortgage is a strategic financial tool, not just an emergency option.

Many believe that only cash-strapped seniors should consider a reverse mortgage, but in reality, many financially stable homeowners use them as part of a well-planned retirement strategy.

Smart Reasons to Consider a Reverse Mortgage:

- To increase cash flow without selling investments (ideal in market downturns)

- To cover healthcare or home renovations while keeping retirement savings intact

- To supplement income while deferring CPP or RRSP withdrawals for tax benefits

- To help family members financially (e.g., gifting a down payment to children)

Fact Check: While a reverse mortgage isn’t right for everyone, it’s not just a last-ditch option. It can be a smart way to unlock home equity while avoiding taxable income or investment losses.

Tip: Before deciding, consult with a financial planner to explore whether a reverse mortgage aligns with your long-term goals rather than viewing it as a last resort.

Conclusion: Is a Reverse Mortgage Right for You?

A reverse mortgage can be a valuable financial tool for Vancouver homeowners who want to unlock their home equity while continuing to live in their property. However, it’s not the right choice for everyone. Before making a decision, it’s important to weigh the benefits and drawbacks, consider alternative financial options, and ensure it aligns with your long-term financial goals.

Key Takeaways from the Pros and Cons

Pros of a Reverse Mortgage:

- Access to tax-free cash without selling your home

- No monthly mortgage payments required

- Allows you to stay in your home while using its equity

- Flexibility in how you receive and use the funds

- Protection against owing more than your home’s value

Cons of a Reverse Mortgage:

- Higher interest rates compared to HELOCs or traditional mortgages

- Home equity decreases over time

- Could impact the inheritance left for your heirs

- Additional fees and penalties may apply

- Limited lender options in Canada

A reverse mortgage makes sense if you need financial flexibility without the burden of monthly payments, but it’s essential to consider the long-term impact on your estate and home equity.

Who Benefits Most from a Reverse Mortgage?

A reverse mortgage may be a good option for:

- Seniors (55+) who want to stay in their Vancouver home but need financial support

- Homeowners with high equity who want access to funds without selling

- Retirees on a fixed income who want to supplement their cash flow

- People who don’t qualify for a HELOC due to low income or poor credit

- Homeowners looking for a tax-free financial solution that won’t impact OAS or GIS

However, if you plan to move within a few years, leave a large inheritance, or qualify for lower-cost alternatives, a reverse mortgage may not be the best choice.

Final Tips for Making an Informed Decision

Before committing to a reverse mortgage, take these important steps:

- Compare alternatives: Explore HELOCs, downsizing, or renting part of your home before making a final decision.

- Understand long-term costs: Ask for a detailed cost projection showing how the loan balance will grow over time.

- Consult a financial advisor: Work with a mortgage broker or financial planner to assess if a reverse mortgage aligns with your financial goals.

- Get independent legal advice: Since reverse mortgages involve a legal contract, a lawyer can help you understand the fine print.

- Talk to your family: If inheritance is a concern, discuss your plans with your children or heirs to ensure transparency.

A reverse mortgage is a long-term financial commitment, and taking the time to evaluate all aspects will help you make a well-informed choice.

FAQs

Can I lose my home if I get a reverse mortgage?

No. You remain the legal owner of your home as long as you meet the loan conditions, such as paying property taxes, maintaining home insurance, and keeping the property in good condition. The lender cannot force you to sell unless you default on these obligations.

How much money can I access with a reverse mortgage?

You can borrow up to 55% of your home’s value, depending on:

- Your age (older homeowners typically qualify for higher amounts)

- Your home’s appraised value and location (Vancouver’s high home prices often allow for larger loans)

- The lender’s policies and loan terms

The exact amount will be determined through a home appraisal and financial assessment by the lender.

What happens to my reverse mortgage if I move or pass away?

If you move out permanently or pass away, the loan must be repaid in full. This usually happens by:

- Selling the home—the proceeds pay off the loan, with any remaining funds going to you or your heirs

- Heirs repaying the loan—if your family wants to keep the home, they can pay off the balance using personal funds or by refinancing

Canadian reverse mortgages include a “No Negative Equity Guarantee”, meaning that if the sale price is less than the loan balance, your family won’t have to pay the difference.

Does a reverse mortgage affect my credit score?

No. Reverse mortgages do not impact your credit score because:

- They don’t require monthly payments, so there’s no risk of missed payments lowering your credit score

- Lenders do not perform a credit check as part of the approval process

However, if you default on property taxes or home insurance payments, it could lead to financial penalties or legal action.

Are there government programs that help seniors with home equity options?

Yes. In addition to reverse mortgages, Canadian seniors in Vancouver can access:

- B.C. Property Tax Deferment Program – Allows eligible seniors to defer property taxes at low interest rates.

- Home Adaptations for Independence (HAFI) Program – Helps fund home modifications to support aging in place.

- Canada Mortgage and Housing Corporation (CMHC) Grants – Provides home improvement assistance for seniors.

Tip: Before committing to a reverse mortgage, check if you qualify for government programs that can provide financial relief without borrowing.