As housing prices continue to rise in Vancouver, many homeowners are looking for ways to access their home equity without selling their property. A reverse mortgage is a popular option for seniors who want to stay in their homes while converting a portion of their home’s value into cash. But how does it work, and is it the right financial decision for you?

This guide will walk you through everything you need to know about reverse mortgages in Vancouver, including how they work, their key differences from traditional mortgages, and common misconceptions.

Understanding Reverse Mortgages

What is a Reverse Mortgage?

A reverse mortgage is a type of loan that allows homeowners aged 55 and older to access a portion of their home’s equity without having to sell or move. Unlike a traditional mortgage, where you make payments to the lender, a reverse mortgage pays you—either as a lump sum, monthly payments, or a combination of both.

Key points about reverse mortgages:

- Available only to homeowners 55 years and older

- The loan amount is based on age, home value, and lender policies

- You retain homeownership and can live in your home as long as you want

- No monthly payments—the loan is repaid when you sell or pass away

Reverse mortgages can be an effective way to supplement retirement income, cover unexpected expenses, or improve financial flexibility, especially in high-cost cities like Vancouver. However, they also come with costs and risks that should be carefully considered.

How Does a Reverse Mortgage Work in Canada?

Reverse mortgages in Canada are regulated and available through lenders such as HomeEquity Bank (CHIP Reverse Mortgage) and Equitable Bank. Here’s how they work:

Loan Amount Determination:

- The amount you can borrow depends on your age, your home’s appraised value, and lender guidelines.

- Typically, you can access up to 55% of your home’s value.

Receiving the Funds:

- Choose between a lump sum, regular payments, or a combination of both.

No Monthly Payments Required:

- Unlike a traditional mortgage, you don’t need to make regular payments.

- Interest accrues over time and is added to the loan balance.

Loan Repayment:

- The loan must be repaid when the homeowner sells the home, moves out permanently, or passes away.

- The home is usually sold, and the proceeds are used to repay the reverse mortgage, with any remaining equity going to the owner or heirs.

Important Note: You must continue paying property taxes, home insurance, and maintenance costs to keep your reverse mortgage in good standing.

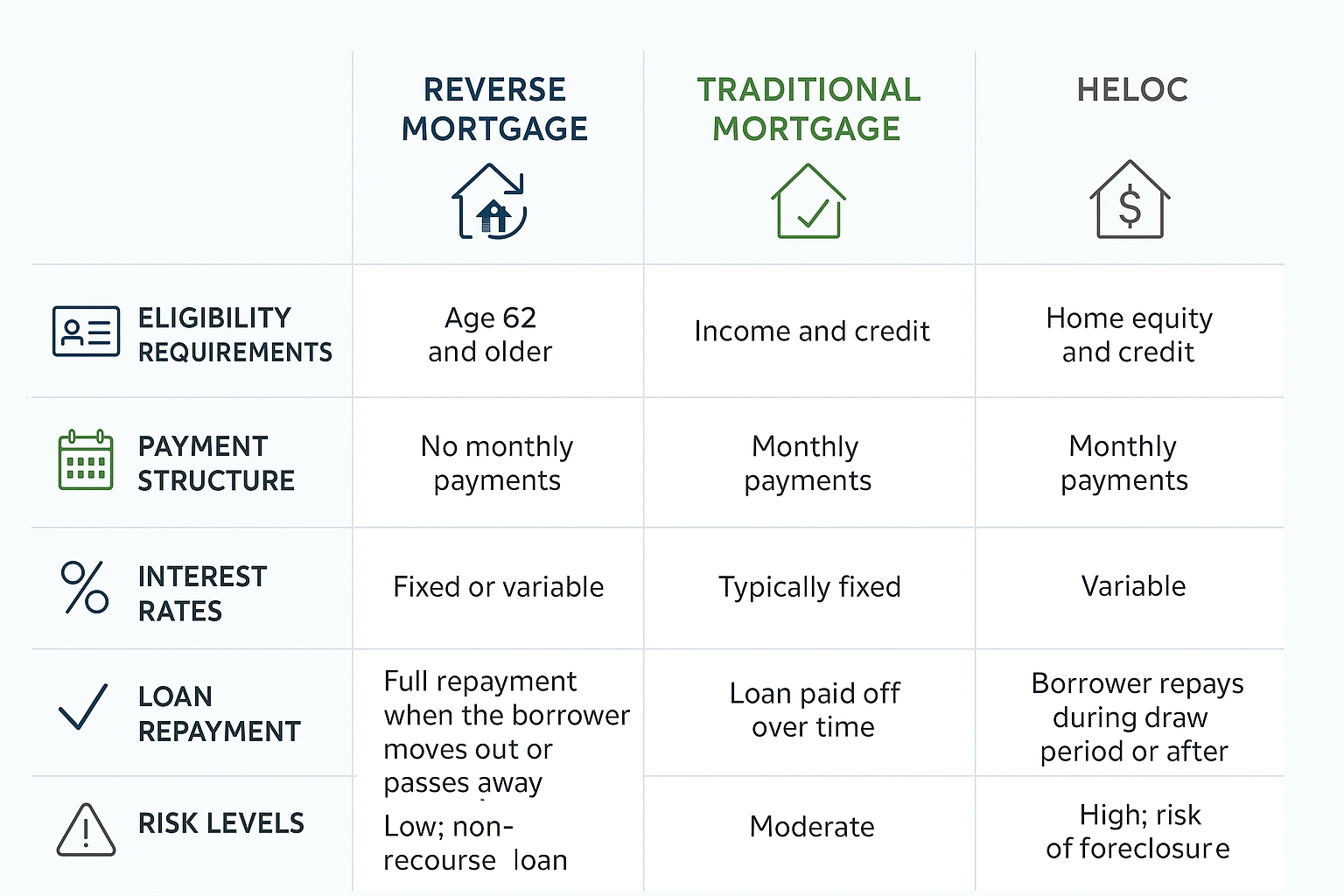

Key Differences Between a Reverse Mortgage and a Traditional Mortgage

Reverse mortgages and traditional mortgages serve different financial purposes and have distinct features. Here’s a comparison:

| Feature | Reverse Mortgage | Traditional Mortgage |

| Eligibility | Age 55+ and homeowner | Anyone meeting lender qualifications |

| Loan Payments | No monthly payments required | Monthly payments required |

| Loan Repayment | Paid off when home is sold or owner passes away | Regular payments over time |

| Access to Equity | Borrow up to 55% of home value | Varies based on income, credit, and down payment |

| Impact on Homeownership | Homeowner retains ownership | Homeowner retains ownership |

| Interest Accumulation | Interest compounds over time, increasing loan balance | Interest is paid regularly, reducing the principal |

Key takeaway: Reverse mortgages provide cash flow without monthly payments, while traditional mortgages require scheduled payments to gradually pay off debt. Reverse mortgages are often used as a financial tool for retirement planning, whereas traditional mortgages are typically for purchasing a home.

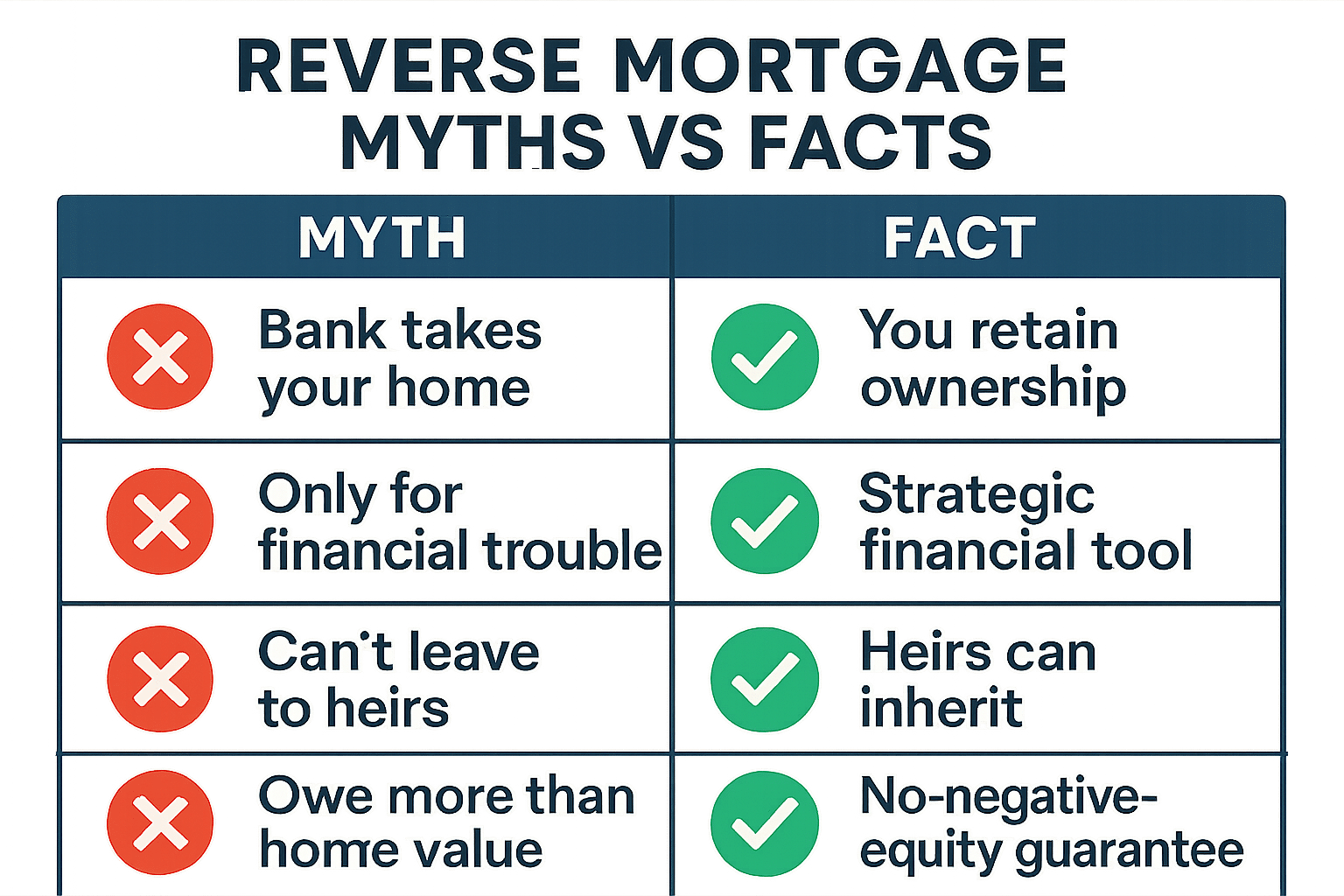

Common Myths and Misconceptions

There are several misconceptions about reverse mortgages that make some homeowners hesitant. Let’s debunk the most common ones:

Myth #1: You lose ownership of your home.

Fact: You remain the legal owner of your home as long as you meet the mortgage conditions (e.g., paying property taxes and insurance).

Myth #2: You must repay the loan immediately if your spouse passes away.

Fact: If both spouses are listed on the reverse mortgage, the surviving spouse can continue living in the home without repaying the loan.

Myth #3: You can owe more than your home is worth.

Fact: Reverse mortgages in Canada come with a no-negative-equity guarantee, meaning you or your heirs will never owe more than the home’s fair market value at the time of sale.

Myth #4: Reverse mortgages are only for people who are struggling financially.

Fact: Many homeowners use reverse mortgages as a strategic financial tool to boost their retirement savings, delay pension withdrawals, or fund home renovations.

Who is Eligible for a Reverse Mortgage in Vancouver?

Before applying for a reverse mortgage in Vancouver, it’s essential to understand the eligibility requirements set by lenders. Reverse mortgages are designed for senior homeowners who want to access their home equity while continuing to live in their property. However, not everyone qualifies.

This section breaks down the key eligibility criteria, including age, home value, property type, financial considerations, and other factors that may impact approval.

Minimum Age and Residency Requirements

To qualify for a reverse mortgage in Vancouver, you must meet the following age and residency criteria:

- Minimum Age Requirement: At least 55 years old (this applies to all homeowners listed on the property title).

- Canadian Residency: You must be a Canadian citizen or permanent resident.

- Primary Residence Rule: The home must be your primary residence (you must live there for at least six months per year).

Important Note: If you have multiple owners listed on the property title, each person must be at least 55 years old to qualify.

Home Value and Property Type Criteria

Lenders determine the loan amount based on the value and type of your home. In Vancouver, where property prices are high, many homeowners qualify for larger reverse mortgages. However, your property must meet specific lender criteria.

Home Value Requirements:

- The home must have a minimum appraised value (varies by lender, typically $250,000+).

- The higher your home value, the more equity you can access (up to 55% of the appraised value).

Eligible Property Types:

- Single-family homes

- Townhouses

- Condominiums (some restrictions may apply)

- Multi-unit residences (if owner-occupied)

Ineligible Properties:

- Vacation homes or secondary residences

- Rental or investment properties

- Some co-op housing units

- Homes with significant structural damage

Tip: If your property has unique zoning or ownership conditions, check with the lender to confirm eligibility.

Credit Score and Income Considerations

Unlike traditional mortgages, reverse mortgages do NOT require a high credit score or proof of steady income. However, lenders may still assess your financial situation to ensure you can afford ongoing homeownership costs.

- No Minimum Credit Score Required: Even if you have poor credit, you may still qualify.

- No Income Verification Needed: Reverse mortgages are based on home equity, not employment or pension income.

What Lenders Do Consider:

- Your ability to pay property taxes, home insurance, and maintenance costs.

- Outstanding debts or liens on the property (must be paid off with the reverse mortgage).

- Whether your financial situation allows you to remain in the home long-term.

Key Takeaway: Even if you have low income or a poor credit history, you can still qualify for a reverse mortgage in Vancouver as long as you own a qualifying property and can cover essential home expenses.

Factors That May Affect Your Eligibility

Even if you meet the basic qualifications, some additional factors may influence your approval and loan amount.

Your Age

- The older you are, the higher the loan amount you can qualify for.

- Younger homeowners (closer to 55) receive a smaller percentage of their home equity compared to older applicants.

Your Home’s Condition

- The home must be in good condition to qualify.

- If your home requires major repairs, the lender may ask you to complete renovations before approving the loan.

Existing Mortgages or Liens

- If you already have a mortgage or a HELOC, you must use the reverse mortgage funds to pay off the remaining balance first.

- Any outstanding property taxes or liens against your home must also be cleared.

Location and Market Conditions

- The home’s location plays a role—Vancouver properties are generally valued higher, increasing eligibility.

- Lenders may consider market stability and neighborhood trends when approving reverse mortgage applications.

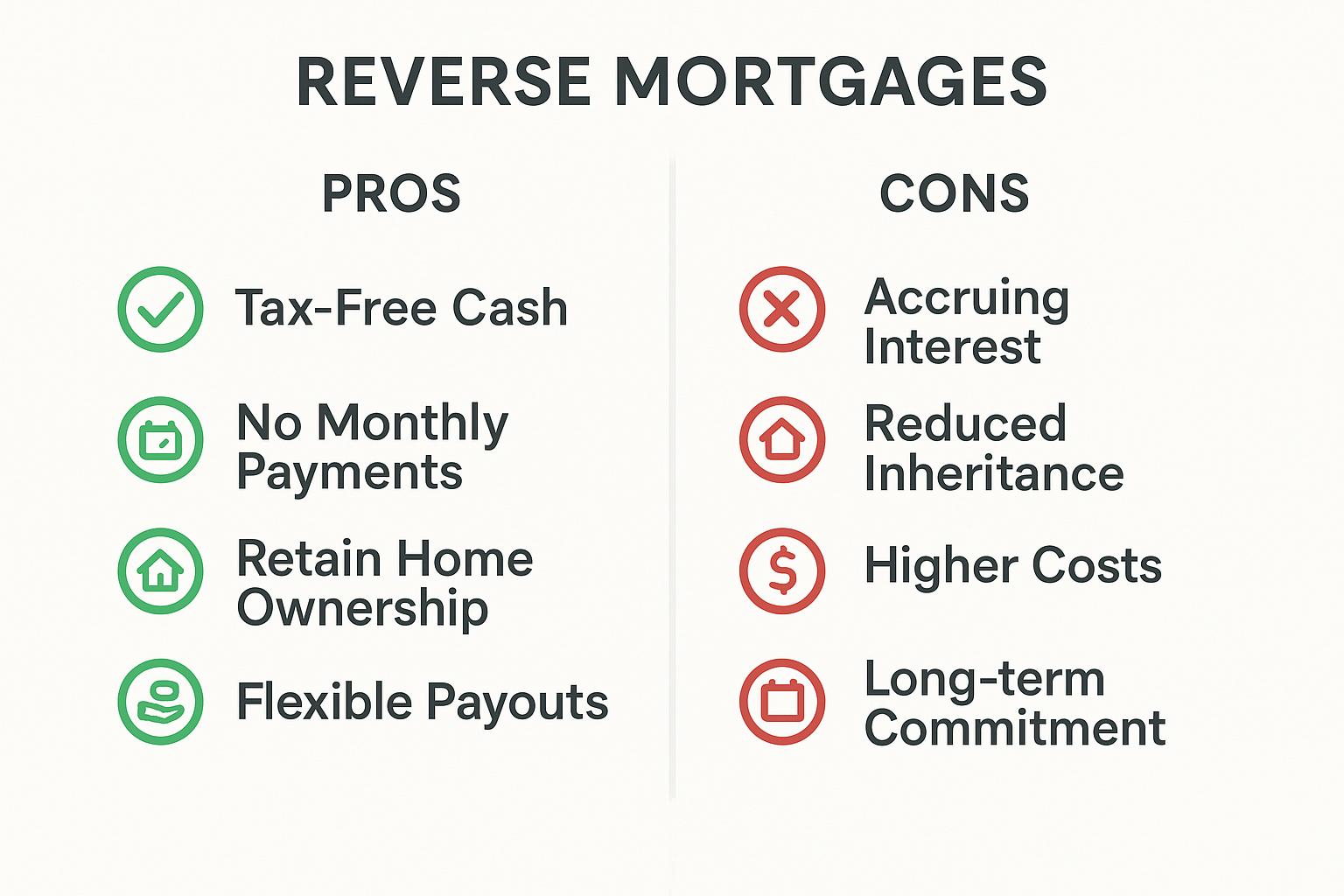

Pros and Cons of Reverse Mortgages

A reverse mortgage can be a useful financial tool for homeowners in Vancouver looking to access their home equity without selling their property. However, like any financial decision, it comes with both advantages and potential drawbacks.

This section outlines the key benefits and risks of taking out a reverse mortgage, helping you make an informed decision based on your financial goals and long-term plans.

Benefits of a Reverse Mortgage

Reverse mortgages offer several advantages, especially for seniors who need extra cash flow while staying in their homes.

Access to Tax-Free Cash

A reverse mortgage provides homeowners with tax-free funds, meaning you won’t pay income tax on the money you receive. This can help cover:

- Daily living expenses

- Medical costs or home healthcare

- Home renovations and repairs

- Travel, leisure, or family support

Unlike selling your home, which could trigger capital gains tax, reverse mortgage proceeds are completely tax-free, as they are classified as a loan rather than income.

No Monthly Mortgage Payments

One of the biggest advantages of a reverse mortgage is that you don’t have to make monthly mortgage payments.

- This relieves financial stress for retirees with fixed incomes.

- The loan is only repaid when you sell the home, move out permanently, or pass away.

Key Takeaway: If you’re struggling with mortgage payments or other debts, a reverse mortgage can help free up cash flow without requiring immediate repayment.

Retain Homeownership While Using Home Equity

Many seniors worry about running out of savings but don’t want to sell their homes. A reverse mortgage allows you to:

- Remain in your home for as long as you want.

- Continue to benefit from appreciating property values in Vancouver.

- Maintain control over your estate and living situation.

Unlike downsizing, which requires relocating and adjusting to a new environment, a reverse mortgage lets you stay in the home you love while using its equity for financial support.

Risks and Drawbacks

While reverse mortgages provide financial flexibility, they also come with potential downsides that homeowners should carefully consider.

Accruing Interest Over Time

Since no monthly payments are required, interest on a reverse mortgage accumulates over time.

- The longer you have the loan, the more interest is added to the balance.

- This means the loan amount can grow significantly if held for many years.

Example: A $200,000 reverse mortgage at 6.5% interest could double in 11 years if left unpaid.

How to Mitigate This:

- Some lenders offer prepayment options to pay down interest over time.

- Borrow only what you need rather than taking a large lump sum upfront.

Reduction of Home Equity for Heirs

A reverse mortgage reduces the amount of home equity left for your heirs.

- Since the loan must be repaid when you pass away, your family may receive less inheritance.

- If home values decrease, there may be little to no equity left after repayment.

Key Consideration: If leaving an inheritance is a priority, consider alternative financial options, such as a Home Equity Line of Credit (HELOC) or downsizing.

Impact on Estate Planning and Inheritance

Reverse mortgages can complicate estate planning, especially if your heirs intend to keep the home.

- The loan must be paid off when the homeowner moves, sells, or passes away.

- If heirs want to keep the home, they must repay the loan using personal funds, refinancing, or selling the home.

Estate Planning Tip:

If you have a reverse mortgage, ensure your will and financial plan account for repayment strategies to avoid burdening your heirs.

How to Apply for a Reverse Mortgage in Vancouver (Step-by-Step)

Applying for a reverse mortgage in Vancouver requires careful planning and understanding of the process. Following these seven key steps will help you navigate the application process smoothly, ensuring you make an informed financial decision that aligns with your long-term goals.

Step 1 – Research and Compare Lenders

Before applying for a reverse mortgage, it’s crucial to research trusted lenders in Canada that specialize in these loans.

Overview of Major Reverse Mortgage Providers in Canada

There are two primary lenders offering reverse mortgages in Canada:

HomeEquity Bank (CHIP Reverse Mortgage)

- Most well-known reverse mortgage provider in Canada

- Offers flexible payment options (lump sum, scheduled withdrawals)

- Provides a no-negative-equity guarantee (you won’t owe more than your home’s value)

Equitable Bank Reverse Mortgage

- Available in major Canadian cities, including Vancouver

- May offer different interest rates compared to CHIP

- Allows borrowers to repay the loan partially over time

How to Assess Lender Credibility and Reputation

- Read customer reviews and testimonials

- Check Better Business Bureau (BBB) ratings and industry credentials

- Compare interest rates, fees, and loan terms

- Consult with an independent financial advisor to understand the fine print

Tip: Avoid lenders that charge excessive fees or pressure you into quick decisions.

Step 2 – Consult a Reverse Mortgage Specialist

Speaking with a reverse mortgage specialist can help you understand the loan structure and whether it suits your financial needs.

Questions to Ask Before Committing

- How much can I borrow based on my home’s value and my age?

- What are the current interest rates and how are they structured?

- Are there prepayment penalties if I want to pay off the loan early?

- What are the total fees involved, including closing costs?

How to Ensure You’re Getting Unbiased Advice

- Work with a specialist who is not directly affiliated with a lender

- Seek guidance from an independent financial planner

- Ask for a detailed breakdown of all costs and obligations

Tip: A reverse mortgage is a long-term commitment—take time to fully understand the implications.

Step 3 – Get a Home Appraisal

Before approving a reverse mortgage, lenders require a home appraisal to determine the property’s market value.

Why Home Valuation Matters

- Determines how much equity you can access (typically up to 55% of the home’s value)

- Confirms that your home is in good condition and meets lender criteria

- Helps lenders assess risk and loan terms

Costs and Timelines for an Appraisal in Vancouver

- Average cost: $300 – $600 (varies by location and appraiser)

- Timeframe: 1 – 2 weeks for appointment and report completion

Tip: Choose a certified appraiser recommended by the lender to avoid delays.

Step 4 – Review Loan Terms and Interest Rates

Not all reverse mortgages have the same terms, so it’s important to compare loan structures before signing an agreement.

Understanding Fixed vs. Variable Rates

- Fixed Rate: The interest rate stays the same for the life of the loan (more predictable).

- Variable Rate: The interest rate fluctuates based on market conditions (can be riskier).

Identifying Hidden Fees and Closing Costs

- Appraisal fees ($300 – $600)

- Legal fees ($1,000 – $2,000)

- Prepayment penalties (if you pay the loan off early)

- Ongoing interest accumulation

Tip: Request a full breakdown of all costs before committing to the loan.

Step 5 – Seek Legal and Financial Advice

Since a reverse mortgage impacts your long-term finances and estate planning, seeking professional advice is crucial.

Why Consulting a Lawyer and Financial Planner is Essential

- A lawyer ensures the loan contract is clear and fair

- A financial planner helps assess if a reverse mortgage is the best financial decision

- Estate planners can explain how the loan affects your heirs

Understanding the Long-Term Financial Impact

- How will interest accumulation affect your remaining home equity?

- Will this loan impact your estate planning and inheritance goals?

- Are there better alternatives, such as downsizing or a Home Equity Line of Credit (HELOC)?

Tip: If family inheritance is a priority, discuss options with your heirs before making a decision.

Step 6 – Submit Your Application

Once you’re confident that a reverse mortgage is the right choice, it’s time to submit your application.

Required Documents and Application Process

- Proof of Age: Government-issued ID (you must be 55+)

- Property Documents: Mortgage statements, home insurance proof

- Income and Tax Records: May be required for tax and insurance purposes

- Home Appraisal Report: Conducted by a certified appraiser

Average Approval Timeline and Next Steps

- Application Review: 1 – 2 weeks

- Lender Approval & Document Signing: 2 – 3 weeks

- Loan Funds Released: Within 4 – 6 weeks from application submission

Tip: The faster you provide all required documents, the quicker your approval process.

Step 7 – Receive Funds and Use Them Wisely

Once approved, you will receive the funds based on the payout method you choose.

Lump Sum vs. Structured Payments

- Lump Sum: One-time large payment (useful for big expenses)

- Scheduled Payments: Monthly or quarterly installments (helps manage cash flow)

- Combination: A mix of both (provides flexibility)

Recommended Ways to Use Reverse Mortgage Proceeds

- Cover daily living expenses and retirement needs

- Pay for home renovations or accessibility upgrades

- Settle existing debts to improve financial security

- Support medical or in-home care expenses

Tip: Avoid using reverse mortgage funds for high-risk investments or non-essential expenses.

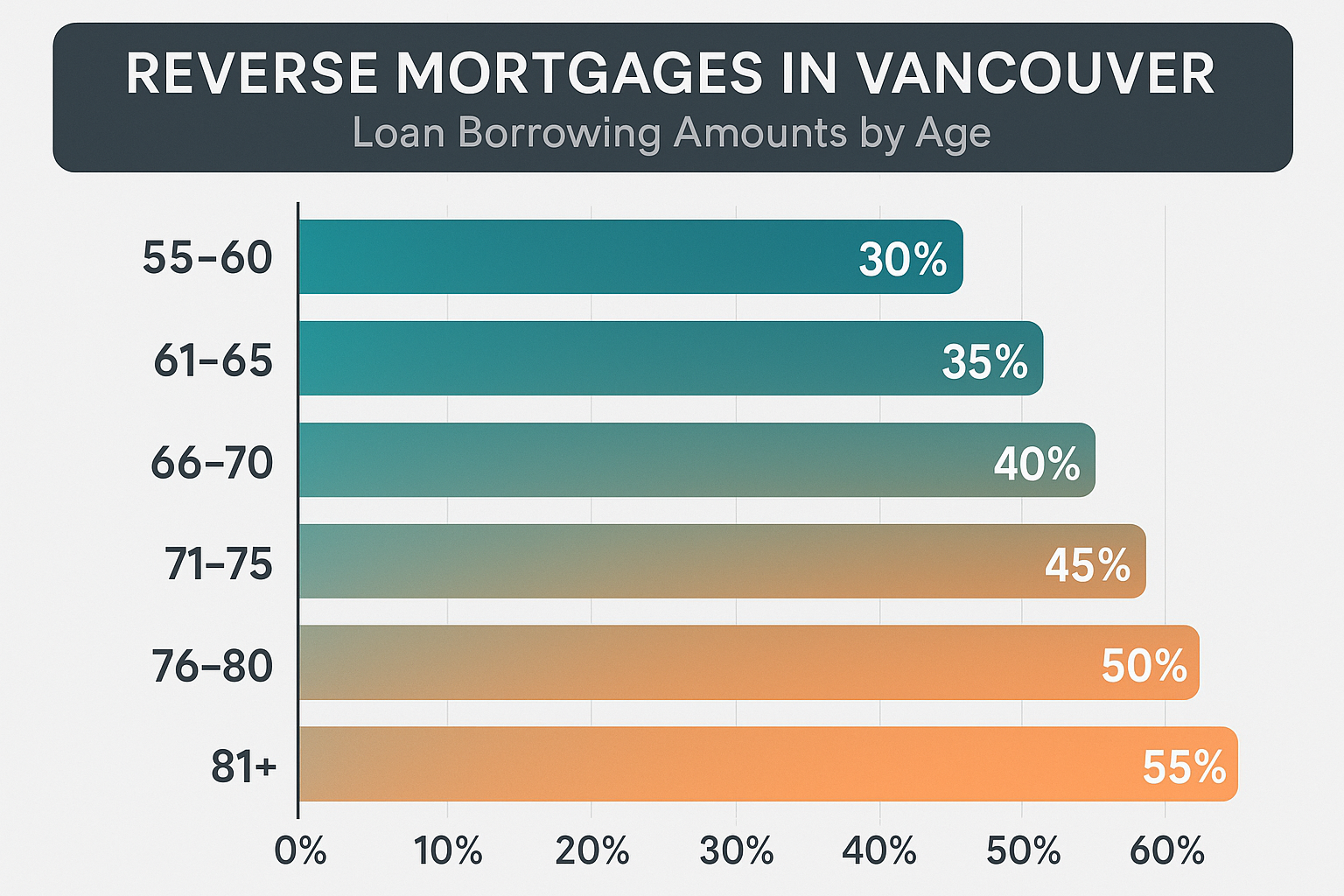

How Much Can You Borrow?

The amount you can borrow with a reverse mortgage in Vancouver depends on several key factors, including your age, home’s appraised value, and lender policies. While most reverse mortgage lenders allow you to borrow up to 55% of your home’s value, the exact loan amount varies based on individual circumstances.

Factors That Determine Your Loan Amount

Age of the Homeowner

Your age is one of the biggest factors in determining how much you can borrow.

- Older homeowners qualify for larger loan amounts because lenders assume a shorter borrowing period.

- Younger applicants (closer to 55) receive lower loan amounts since interest accumulates over a longer period.

- Some lenders increase the borrowing percentage as you age (e.g., a 75-year-old may qualify for a higher loan percentage than a 60-year-old).

Key Takeaway: The older you are, the more equity you can access from your home.

Home’s Appraised Value

Since a reverse mortgage is secured by your home, the appraised value plays a critical role in determining your loan amount.

- Higher-value homes qualify for larger loan amounts.

- Lenders will conduct a professional home appraisal to determine the fair market value.

- Vancouver’s high real estate prices often allow homeowners to qualify for the maximum loan percentage.

Tip: Keeping your home well-maintained can positively impact the appraisal value.

Lender Policies and Risk Assessment

Different lenders have unique risk assessments that may impact how much they offer.

- Loan-to-Value (LTV) Ratio: Lenders determine the percentage of home equity they are willing to lend.

- Market Conditions: If the real estate market is unstable, lenders may adjust borrowing limits.

- Existing Debts & Liabilities: Any outstanding mortgage or liens will reduce the amount you can borrow.

Key Takeaway: Even if your home is worth $2 million, lenders won’t allow you to borrow 100% of its value. The limit remains at 55% maximum, depending on age and other risk factors.

Example Calculation for a Reverse Mortgage in Vancouver

Below is an estimated breakdown of potential reverse mortgage amounts based on age and home value:

Estimated Loan Amounts by Age and Home Value

| Age of Homeowner | Home Value: $750,000 | Home Value: $1,000,000 | Home Value: $1,500,000 |

| 55 years old | $225,000 (30%) | $300,000 (30%) | $450,000 (30%) |

| 65 years old | $300,000 (40%) | $400,000 (40%) | $600,000 (40%) |

| 75 years old | $375,000 (50%) | $500,000 (50%) | $750,000 (50%) |

| 85 years old | $412,500 (55%) | $550,000 (55%) | $825,000 (55%) |

Assumptions:

- Loan-to-value (LTV) percentage increases with age.

- Maximum borrowing limit is 55% of the home’s appraised value.

- The table reflects estimated values and may vary based on lender policies and market conditions.

Key Takeaway:

- A 55-year-old can access about 30% of their home’s value, while an 85-year-old can borrow closer to 55%.

- Vancouver’s high property values mean that many homeowners can access substantial loan amounts through a reverse mortgage.

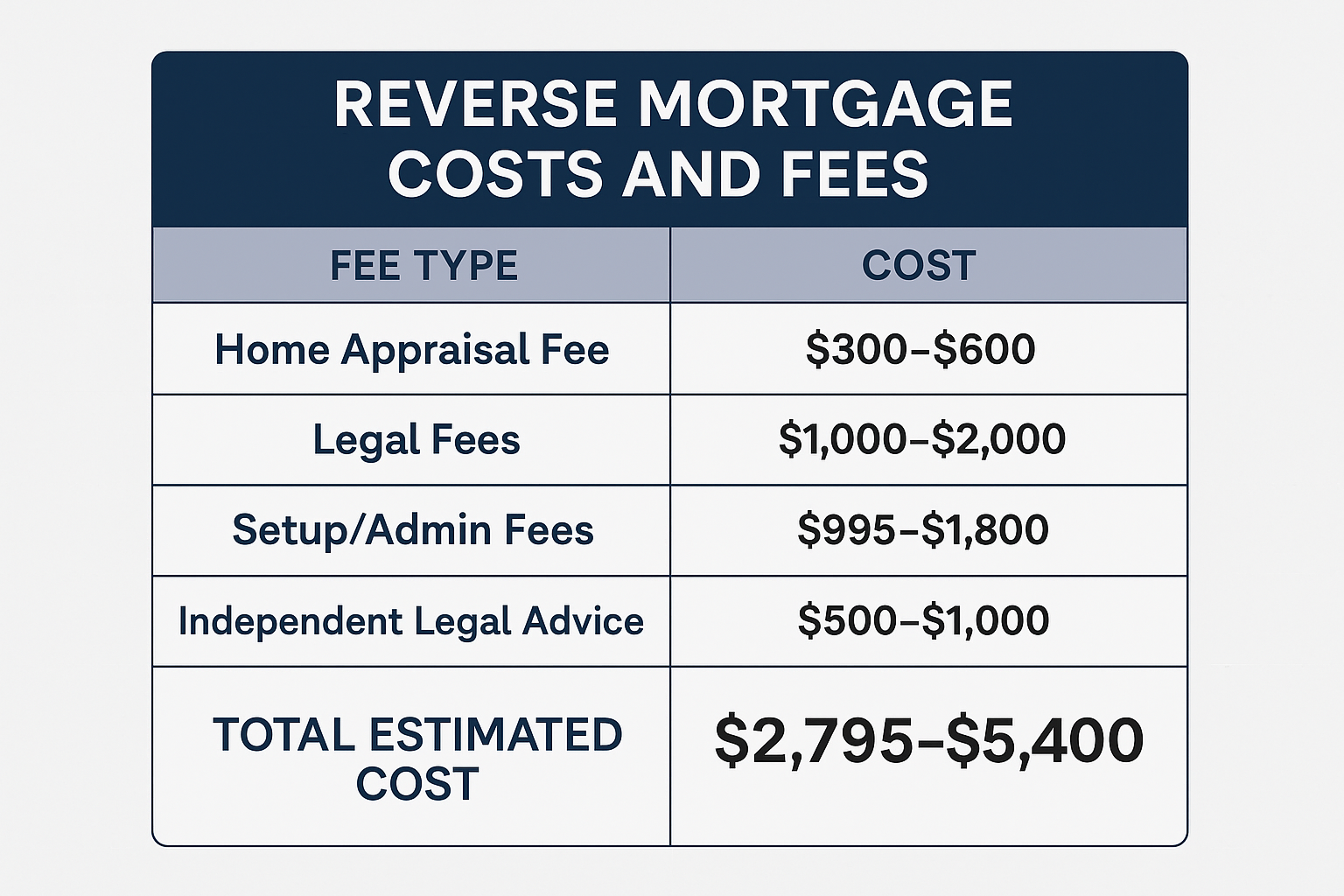

Costs and Fees Associated with Reverse Mortgages

While reverse mortgages provide homeowners in Vancouver with tax-free cash and financial flexibility, they come with various costs and fees that should be carefully considered. These expenses include interest rates, upfront fees, and ongoing property costs, all of which can impact the total amount owed over time.

This section breaks down the main costs associated with reverse mortgages and provides practical strategies to minimize them.

Interest Rates and How They Are Determined

Like traditional mortgages, reverse mortgages charge interest, which accrues over time. Since borrowers don’t make monthly payments, interest is added to the loan balance, increasing the total amount owed.

Types of Reverse Mortgage Interest Rates in Canada

- Fixed Interest Rate: The rate remains the same for the life of the loan, making it easier to predict total costs.

- Variable Interest Rate: The rate fluctuates based on market conditions, potentially increasing borrowing costs over time.

Factors That Influence Reverse Mortgage Interest Rates

- Lender policies (CHIP HomeEquity Bank vs. Equitable Bank)

- Current Bank of Canada interest rates

- Loan structure (lump sum vs. scheduled payments)

- Borrower’s age and risk profile

Tip: Reverse mortgage interest rates are generally higher than traditional mortgage rates because lenders assume greater risk by deferring repayment. Always compare rates from multiple lenders before making a decision.

Closing Costs and Other Upfront Fees

Reverse mortgages require upfront fees that vary depending on the lender and property. These costs are usually deducted from the loan proceeds, meaning you won’t have to pay them out of pocket.

| Fee Type | Estimated Cost in Vancouver | Purpose |

| Home Appraisal Fee | $300 – $600 | Determines the market value of your home. |

| Legal Fees | $1,000 – $2,000 | Covers lawyer review, documentation, and closing costs. |

| Setup / Administration Fees | $995 – $1,800 | Lender fees for processing the reverse mortgage. |

| Independent Legal Advice (Optional) | $500 – $1,000 | Some lenders require proof of legal consultation before signing. |

Tip: Always ask lenders for a full breakdown of all fees before signing any agreements to avoid hidden costs.

Ongoing Expenses (Property Taxes, Insurance, Maintenance)

Even though a reverse mortgage eliminates monthly payments, homeowners must continue paying for property-related expenses to keep the loan in good standing.

Property Taxes:

- Must be paid on time to avoid defaulting on the loan.

- Eligible seniors can apply for BC’s Property Tax Deferment Program to reduce costs.

Home Insurance:

- Reverse mortgage lenders require homeowners to maintain adequate insurance coverage.

- Failure to maintain insurance can result in loan default.

Home Maintenance & Repairs:

- Lenders expect borrowers to keep their home in good condition.

- Major damage (e.g., roof leaks, structural issues) may impact the loan terms or eligibility.

Key Takeaway: Even with a reverse mortgage, ongoing homeownership costs remain your responsibility.

How to Minimize Costs and Get the Best Deal

Reverse mortgage costs can add up over time, so it’s important to explore ways to reduce expenses and maximize benefits.

1. Compare Interest Rates and Lender Fees

- Request quotes from multiple lenders (HomeEquity Bank vs. Equitable Bank).

- Consider a variable rate if interest rates are expected to drop.

2. Borrow Only What You Need

- Take only the minimum required funds to reduce interest accumulation.

- Consider scheduled payments rather than a lump sum to control costs.

3. Use the BC Property Tax Deferment Program

- Eligible seniors can delay property tax payments to free up cash flow.

- This program helps reduce financial strain while keeping the loan in good standing.

4. Pay Down Interest if Possible

- Some reverse mortgage lenders allow partial prepayments to reduce interest accumulation.

- If you receive a financial windfall, consider making small payments toward the loan balance.

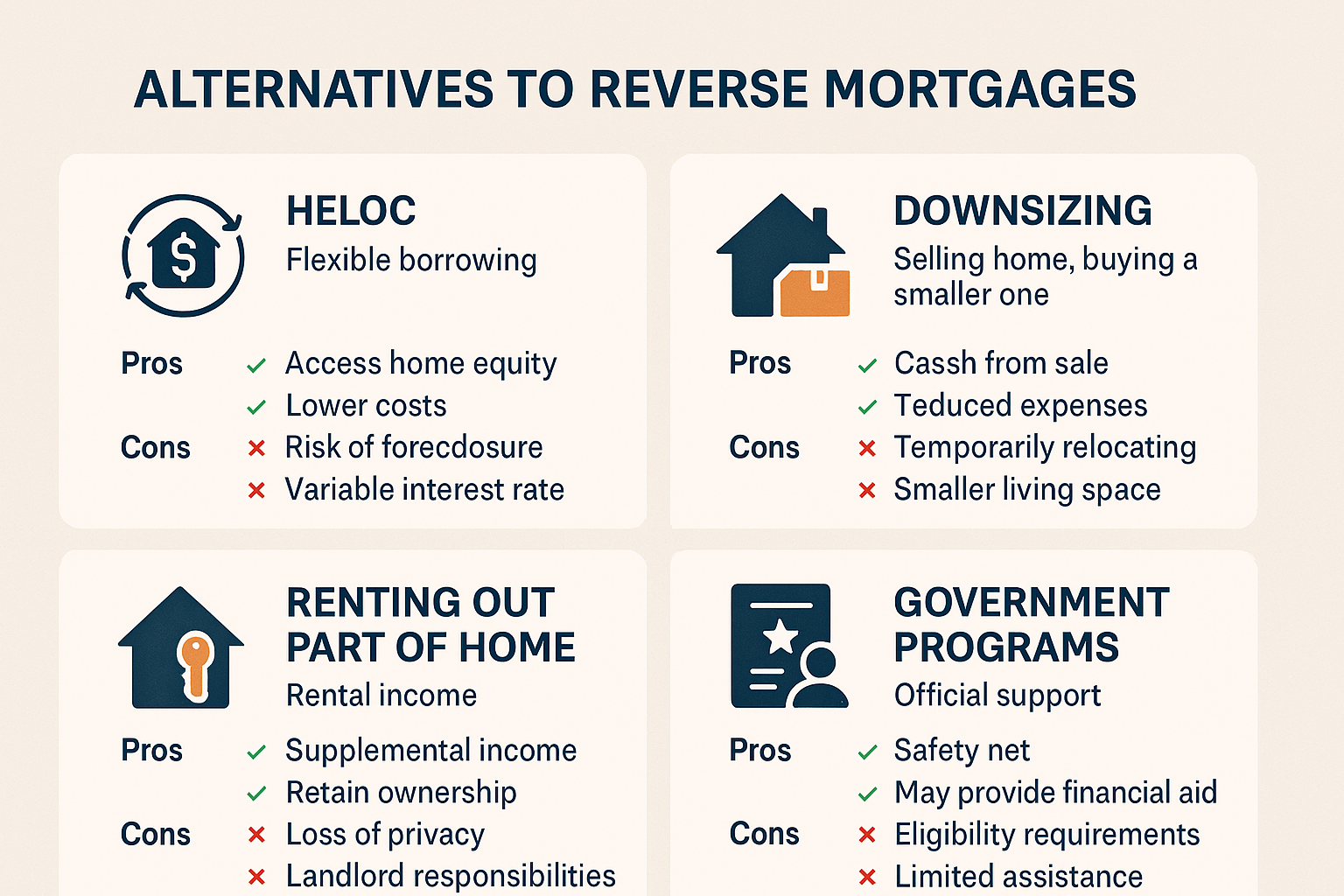

Alternatives to a Reverse Mortgage

While a reverse mortgage can be a useful tool for accessing home equity without selling, it’s not the only option available for Vancouver homeowners. Depending on your financial goals, alternative solutions may provide more flexibility, lower costs, or better long-term benefits.

This section explores four main alternatives to a reverse mortgage, helping you make the most informed decision for your financial future.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their home’s equity while maintaining full ownership and control of their property. Unlike a reverse mortgage, a HELOC lets you withdraw money as needed rather than receiving a lump sum.

Benefits of a HELOC

- Lower interest rates compared to reverse mortgages

- Flexible withdrawals—borrow only what you need

- You maintain full home equity ownership

Drawbacks of a HELOC

- Requires monthly interest payments

- Requires good credit and steady income to qualify

- Risk of foreclosure if payments are missed

Best For: Homeowners who want flexible access to home equity but can still manage monthly payments.

Downsizing to a Smaller Home

Instead of taking out a loan, many Vancouver seniors choose to sell their home and move into a smaller, more affordable property. This allows you to convert home equity into cash while also reducing homeownership costs like property taxes, maintenance, and utilities.

Benefits of Downsizing

- Immediate access to full home equity—no interest or loan fees

- Lower living expenses (reduced taxes, insurance, and upkeep)

- Freedom to relocate (e.g., move closer to family or a retirement community)

Drawbacks of Downsizing

- Selling your home can be emotional and time-consuming

- High real estate transaction costs (realtor fees, closing costs, moving expenses)

- Finding an affordable home in Vancouver can be challenging

Best For: Homeowners looking for long-term financial security and a simpler, more manageable lifestyle.

Renting Out a Portion of Your Home

If you want to stay in your home but need extra income, renting out part of your property—such as a basement suite or spare room—can generate consistent, passive income without taking on debt.

Benefits of Renting Out a Portion of Your Home

- Steady monthly income to cover expenses

- No loss of home equity or inheritance value

- Ability to remain in your home while increasing financial flexibility

Drawbacks of Renting Out a Portion of Your Home

- Requires landlord responsibilities (tenant management, maintenance, legal obligations)

- May require renovations to make the space livable and compliant with city regulations

- Tenant issues (non-payment, property damage, conflicts)

Best For: Homeowners with extra living space who are comfortable with being a landlord and want additional income.

Vancouver-Specific Government Assistance Programs

For seniors looking to reduce financial strain without taking on debt, Vancouver and BC offer several government programs designed to help with property taxes, home renovations, and senior living expenses.

BC Property Tax Deferment Program

The BC Property Tax Deferment Program allows eligible seniors to delay paying their property taxes at a low interest rate, freeing up cash for other expenses.

- Available to homeowners aged 55+

- Low interest rate (significantly lower than reverse mortgage rates)

- No impact on home ownership—you still own your home fully

- Taxes must be repaid when the home is sold or transferred

Best For: Seniors who need to reduce expenses but want to avoid borrowing against their home equity.

Home Renovation Grants for Seniors

For seniors who need to upgrade their home for safety or accessibility, the BC government offers grants and rebates to help cover renovation costs.

- BC Rebate for Accessible Home Adaptations (BC RAHA): Covers renovations like grab bars, ramps, stairlifts, and accessible bathrooms.

- Federal Home Accessibility Tax Credit: Allows seniors to claim up to $10,000 in eligible renovation costs on their tax return.

- FortisBC Energy Conservation Assistance Program: Provides free energy-efficient upgrades for seniors with low incomes.

Best For: Homeowners who want to stay in their home but need financial help for renovations.

Choosing the Right Reverse Mortgage Lender in Vancouver

Selecting the right reverse mortgage lender is crucial to ensuring you get the best loan terms, competitive interest rates, and fair contract terms. Vancouver has a few major lenders offering reverse mortgages, but not all lenders are equal.

This section outlines key factors to consider when choosing a lender, reviews the top reverse mortgage providers in Vancouver, and provides tips on avoiding scams and predatory lending practices.

Key Factors to Consider When Selecting a Lender

When evaluating a reverse mortgage lender, consider the following:

- Interest Rates & Fees – Compare both fixed and variable interest rates, closing costs, and ongoing fees.

- Loan Terms & Repayment Flexibility – Look for prepayment options and clear repayment terms.

- Maximum Loan Amount – Different lenders may offer different borrowing limits based on your age and home value.

- Lender Reputation & Customer Reviews – Choose lenders with a strong track record and positive client feedback.

- No-Negative-Equity Guarantee – Ensure the lender offers protection against owing more than your home’s value.

- Customer Support & Guidance – A good lender should provide clear, unbiased guidance throughout the process.

Tip: Request a detailed cost breakdown from multiple lenders before making a decision.

Leading Reverse Mortgage Lenders in Vancouver

In Canada, only a few financial institutions specialize in reverse mortgages. These are the primary providers in Vancouver:

HomeEquity Bank (CHIP Reverse Mortgage)

- Canada’s largest and most well-known reverse mortgage provider.

- Offers lump sum, monthly advances, or a combination of both.

- Provides a No-Negative-Equity Guarantee—you won’t owe more than your home’s value.

- Available to Canadian homeowners aged 55+.

- Typically higher interest rates than traditional mortgages.

Best for: Homeowners looking for a reliable, well-established lender with flexible payout options.

Equitable Bank Reverse Mortgage

- A newer alternative to CHIP, offering competitive rates.

- Available in major Canadian cities, including Vancouver.

- Offers partial prepayment options, allowing borrowers to pay down the loan.

- Maximum loan amount varies based on age and home value.

Best for: Homeowners who want an alternative to CHIP with lower rates or more flexibility.

Other Regional Financial Institutions

Some credit unions and private lenders may offer customized home equity loan solutions, which can work similarly to a reverse mortgage. However, these loans often:

- Do not offer No-Negative-Equity Guarantees

- Have higher interest rates

- Require credit checks and income verification

Best for: Homeowners who want alternative financing options but should be cautious about lender terms.

How to Avoid Scams and Predatory Lenders

Reverse mortgages can be beneficial, but some lenders may take advantage of uninformed borrowers. Here’s how to spot red flags and protect yourself:

Red Flags to Watch For

- High-pressure sales tactics – A reputable lender will never rush you into signing.

- Hidden fees and unclear terms – All costs should be fully disclosed upfront.

- Unlicensed or unknown lenders – Always choose a regulated financial institution.

- Offers that sound too good to be true – Reverse mortgages have costs; beware of lenders promising unrealistic benefits.

Ensuring a Transparent and Fair Loan Agreement

- Review loan documents carefully – Get a legal professional to read the fine print.

- Ask about prepayment penalties – Some lenders charge high fees if you repay early.

- Confirm your loan amount and payout options – Make sure your loan terms match what was initially offered.

- Consult a financial planner – They can compare different options and provide independent advice.

Key Takeaway: Stick with reputable lenders like HomeEquity Bank and Equitable Bank to avoid risks.

What Happens When You Move, Sell, or Pass Away?

A reverse mortgage provides financial flexibility, but it must be repaid when you move, sell your home, or pass away. Understanding the repayment process and how it impacts your estate is crucial for planning ahead.

Repayment Terms for a Reverse Mortgage

A reverse mortgage must be repaid when:

- The home is sold

- The last borrower moves out permanently (e.g., into a care facility)

- The borrower passes away

How Repayment Works:

- The loan balance includes the original amount borrowed plus accumulated interest.

- The loan must be repaid in full, typically within six months of the homeowner passing away or moving out.

- Heirs or estate executors can repay the loan using:

- Proceeds from selling the home

- Personal funds or refinancing options

Tip: If you plan to stay in your home long-term, ensure your family or estate executor understands the repayment process.

Impact on Estate and Heirs

A reverse mortgage reduces home equity, which means there may be less inheritance left for heirs.

- If there is equity remaining after loan repayment, heirs receive the remaining funds.

- If the loan balance equals the home’s value, heirs receive no additional inheritance from the home.

- If heirs want to keep the home, they must repay the reverse mortgage—either using personal savings or refinancing.

Key Takeaway: If leaving an inheritance is a priority, consider alternatives like a HELOC or downsizing.

What Happens if the Home is Worth Less Than the Loan?

Many homeowners worry about owing more than their home’s value, but Canadian reverse mortgages come with a No-Negative-Equity Guarantee.

- If the home sells for less than the loan amount, the lender absorbs the loss.

- Heirs will never owe more than the fair market value of the home.

- The estate is not responsible for covering the shortfall.

Tip: This protection ensures that reverse mortgage borrowers won’t leave debt behind for their heirs.

Can You Pay Off a Reverse Mortgage Early?

Yes, you can pay off a reverse mortgage before selling or passing away, but there may be prepayment penalties depending on the lender and timing.

- Some lenders allow partial payments to reduce interest accumulation.

- If you sell your home early, you may be required to pay an early termination fee.

- If the borrower passes away, no prepayment penalty applies—the full balance is simply due.

Best Practice: If you think you might sell or move in the near future, ask the lender about prepayment penalties before signing.

Common Mistakes to Avoid

Reverse mortgages can be beneficial, but some common mistakes can lead to higher costs and financial challenges.

Borrowing More Than Necessary

- Since interest accumulates over time, only borrow what you actually need.

- Consider scheduled payments instead of a lump sum to minimize interest.

Tip: Borrowing only what’s necessary preserves more equity for the future.

Not Understanding Loan Terms Fully

Some homeowners don’t realize how interest compounds and how quickly the loan balance can grow.

Be aware of closing costs, fees, and repayment terms.

Tip: Always have a financial advisor or lawyer review your loan agreement before signing.

Failing to Explore Alternative Financial Solutions

Reverse mortgages aren’t the only option—consider:

- HELOCs (Home Equity Lines of Credit) for flexible borrowing

- Downsizing to a smaller, more manageable home

- Government programs like BC’s Property Tax Deferment

Tip: Compare all available options before committing to a reverse mortgage.

Neglecting to Plan for Future Costs

Homeowners must still pay property taxes, insurance, and maintenance.

If a homeowner’s health changes, long-term care costs may affect financial stability.

Tip: Have a long-term financial plan to ensure you can afford to stay in your home.

Conclusion

Deciding whether a reverse mortgage is right for you depends on your financial needs, long-term goals, and home equity situation. While it can provide tax-free cash flow without requiring monthly payments, it also reduces home equity and can impact estate planning.

Is a Reverse Mortgage the Right Choice for You?

A reverse mortgage may be a good option if you:

- Are 55 or older and need extra funds for retirement expenses.

- Want to stay in your Vancouver home without selling.

- Have significant home equity and want to access cash without monthly payments.

- Have no plans to move in the near future.

However, a reverse mortgage may not be the best choice if you:

- Want to maximize inheritance for your heirs.

- Plan to sell or move within the next few years.

- Can qualify for a HELOC or other financial alternatives with lower costs.

- Are concerned about long-term interest accumulation.

Key Takeaway: A reverse mortgage is best suited for homeowners who plan to stay in their home long-term and need financial flexibility without monthly loan payments.

Next Steps for Those Interested in Applying

If you’re considering a reverse mortgage, follow these steps to make an informed decision:

- Compare Lenders: Look at interest rates, fees, and loan terms from HomeEquity Bank (CHIP) and Equitable Bank.

- Seek Professional Advice: Consult a financial planner or lawyer to understand the full implications.

- Review Alternative Options: Consider downsizing, a HELOC, or government programs before committing.

- Understand Loan Terms: Ensure you’re clear on repayment conditions, costs, and estate impact.

- Plan for Future Expenses: Budget for property taxes, insurance, and maintenance costs to stay financially secure.

Where to Get Help:

- Certified Financial Advisors: Provide independent financial planning for seniors.

- Mortgage Brokers: Can compare reverse mortgage options for you.

- Legal Professionals: Ensure loan agreements are transparent and fair.

- Government Resources: Check the BC Seniors’ Financial Assistance Programs for support.

FAQs

1. Will a reverse mortgage affect my pension or Old Age Security (OAS)?

No, a reverse mortgage does not affect OAS, CPP, or GIS benefits, as the funds are considered borrowed money, not income.

2. Can I apply for a reverse mortgage if I have an existing mortgage?

Yes, but the existing mortgage must be paid off first using the reverse mortgage proceeds. The remaining funds can be used as you wish.

3. What happens if I outlive my reverse mortgage?

Reverse mortgages do not expire as long as you continue living in your home and meet the loan conditions (paying property taxes and insurance).

4. How long does the application process take?

The entire process typically takes 4 to 6 weeks, including:

- Home appraisal (1-2 weeks)

- Lender approval (1-2 weeks)

- Legal paperwork and fund release (1-2 weeks)

5. Can my spouse continue to live in the home if I pass away?

Yes, if your spouse is a co-borrower on the reverse mortgage, they can remain in the home without making payments. If they are not listed on the loan, they may have to repay the loan or sell the home.